In the past two decades, we watched how technology changed life as we knew it. Various industries scrambled to keep up with the latest developments, requirements and global-trends. The banking sector was of course not left out, as daily transactions and activities progressively moved from traditional methods to digital ones, with regular smartphones now serving as an essential tool for banking.

Now, in 2023, the standard international expectation is that customers - in their own time, on their phones, by themselves, can do a number of banking transactions and actions; check their account balance, transfer money, create bank accounts, pay bills, access efficient customer care service, cardless ATM withdrawals, amongst other actions.

This research shows that an efficient and well-functioning banking system is intricate to economic growth and poverty alleviation (something that Nigeria struggles with at the moment). The reality of the inefficiency of Nigeria's digital banking system has become undeniable to all, after its collapse. As it could not keep up with the Central Bank of Nigeria's(CBN) recent regulations which restricted the flow of cash during the pre-election and post-election period.

The digital banking system in Nigeria has experienced a surge in fraudulent activities, prompting the Central Bank of Nigeria (CBN) to develop policies aimed at curbing such activities. One such policy is the mandatory Bank Verification Number (BVN) requirement for all bank accounts in Nigeria, amongst others. Prior to the cashless era, Nigerian banks had already started implementing increasingly restrictive measures, such as reducing FX and card limits on international purchases, which eventually led to a ban on such transactions.

The Central Bank of Nigeria recently ranked a number of banks as "top-rated". This article aims to provide a comparison of the actual experience of using these top-rated Nigerian banks. The banks that will be discussed include: Access Bank, Ecobank, Fidelity Bank, First Bank, First City Monument Bank (FCMB), Globus Bank, Guarantee Trust Bank, Heritage Bank, Keystone Bank, Polaris Bank(formerly Skye Bank), Stanbic IBTC Bank, Standard Chartered Bank, Sterling Bank, Titan Trust Bank, Union Bank, United Bank of Africa(UBA), Unity Bank, Wema Bank and Zenith Bank. Just before rounding up, we’d touch on Challenger banks like OPay and Kuda Bank.

Each of the aforementioned banks will be analysed based on the following points:

- Ability to open an account via a bank’s mobile app - how soon do these banks verify the customer with their BVN before gaining access to banking services?

- Which bank allows freezing accounts and cards on their mobile app

- Which bank’s mobile apps have been reliable - especially during the pre-election period in February 2023

- Rating Nigerian bank’s customer support service

- The reality of using Challenger banks in Nigeria - how reliable have they been?

Ability to open an account via a bank’s mobile app - how soon do these banks verify the customer with their BVN before gaining access to banking services?

Internationally, opening a bank account has been simplified. Customers do not need to enter a physical bank to open one while still being accurately identified and verified by the bank.

While most Nigerian banks offer the option of opening an account through their mobile applications, the question remains whether customers can effectively set up and perform transactions on these accounts using only their mobile phones.The point of this section is not just to find out if a customer has the option of opening an account on a bank’s mobile app but also, if in the first few screens, the customer is accurately identified and verified by the bank with their BVNs. Thereby, following the CBN’s policy aimed at reducing the rate of fraud perpetrated by the lack of it.

To ensure a successful implementation, the CBN provided answers to other Frequently Asked Questions(FAQs) on the BVN policy.

Now the questions are, which banks have handled this efficiently? How security conscious is the bank? Do these banks require BVNs for all types of accounts offered on their mobile apps? How soon do they comply with the BVN policy? That’s what we are about to find out, as it can greatly reduce the time spent in the onboarding process of a customer. The steps the customers take on the mobile applications will be displayed and a checklist is provided at the end of the analysis, in this section.

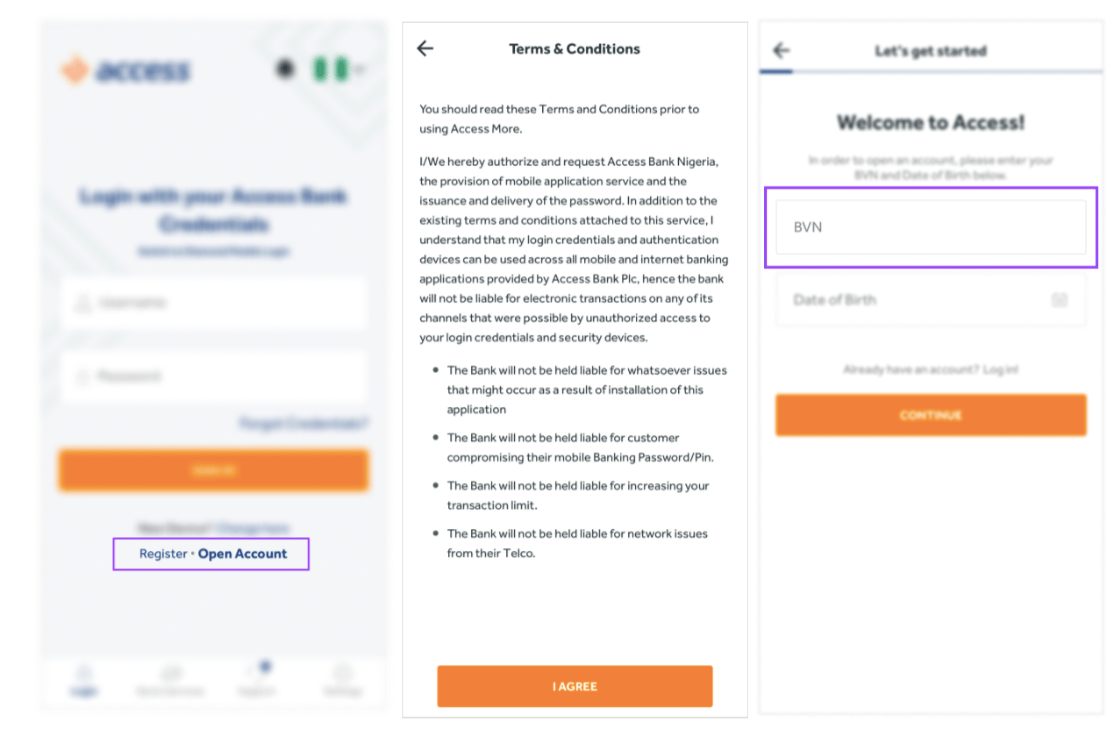

Access Bank

As shown below, Access bank allows its customers to open a new bank account on their mobile app. The bank also has the compulsory requirement of agreeing to their terms and conditions, followed by the mandatory request of the BVN and date of birth to continue the process.

Access Bank's security measures are commendable as they do not accept randomly generated BVNs, or BVNs that do not match the customer's provided date of birth. An example is shown below where the date of birth entered did not match the BVN provided.

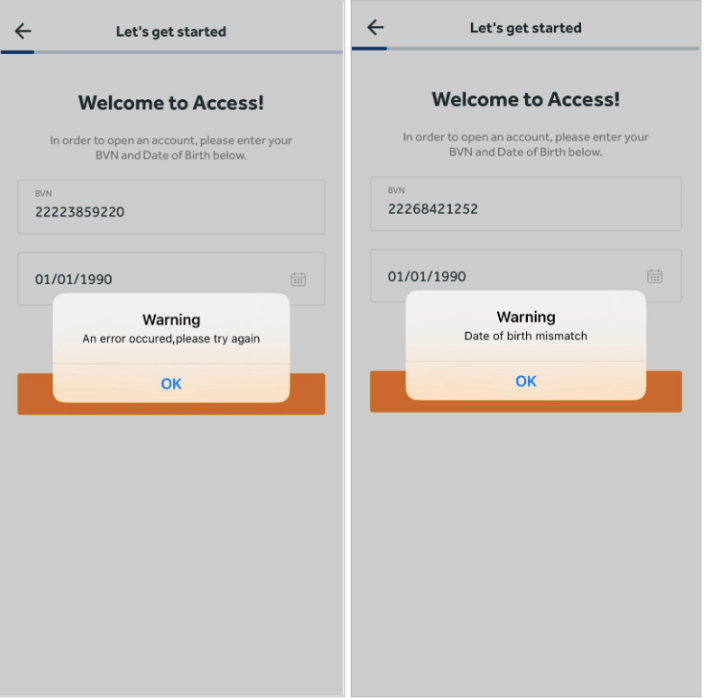

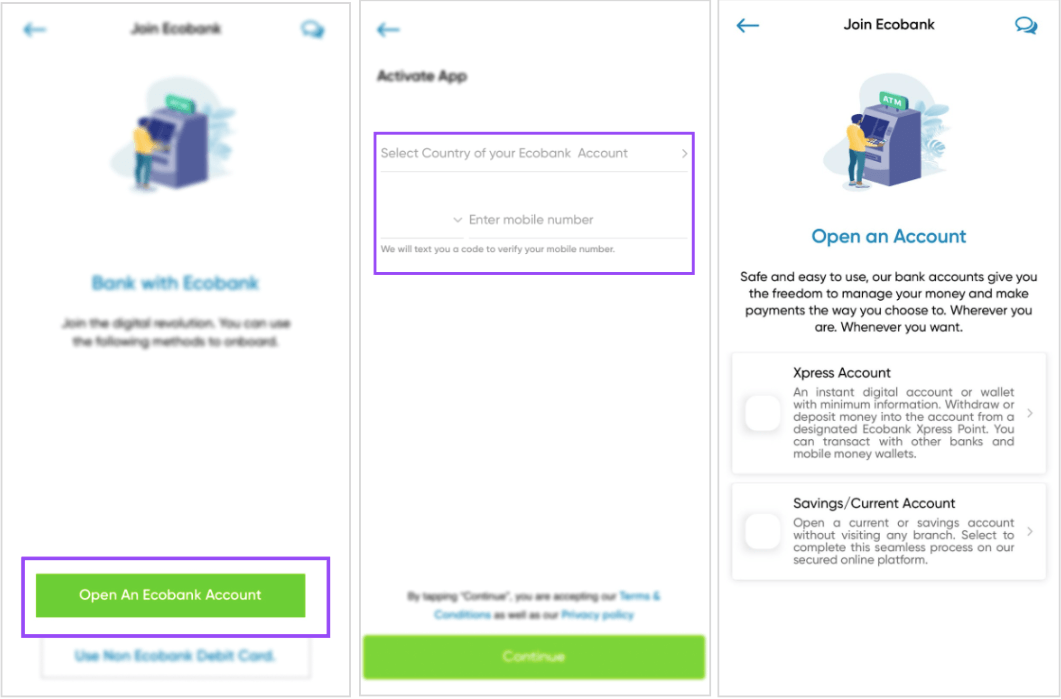

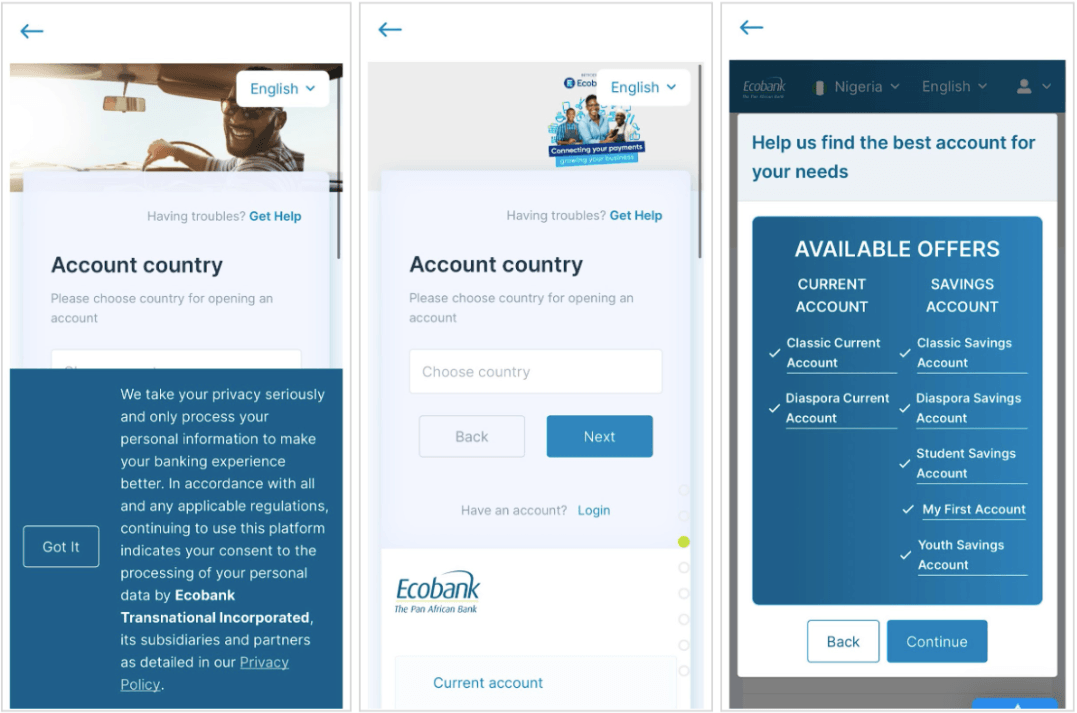

Ecobank

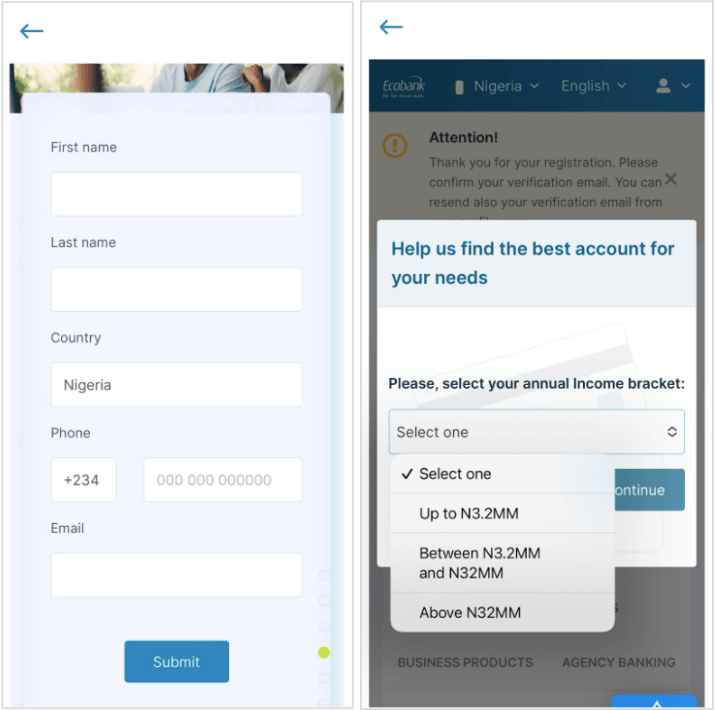

Ecobank allows its customers to open a new bank account on the mobile app. Being a Pan African bank, multiple requests were made to indicate the customer’s country (these screens were skipped). As shown below, there was no request for the customer’s Bank Verification Number. The focus was on phone number (repeated requests were made), name, email address and location.

This process seems more like a mobile version of their website, rather than a mobile app - note the privacy policy notification on the fifth screen. Furthermore, the onboarding process for Ecobank is quite long, the customer has created a profile within the first couple of screens without being verified with their BVN, and repeated requests were made for the customer to select the account type they want.

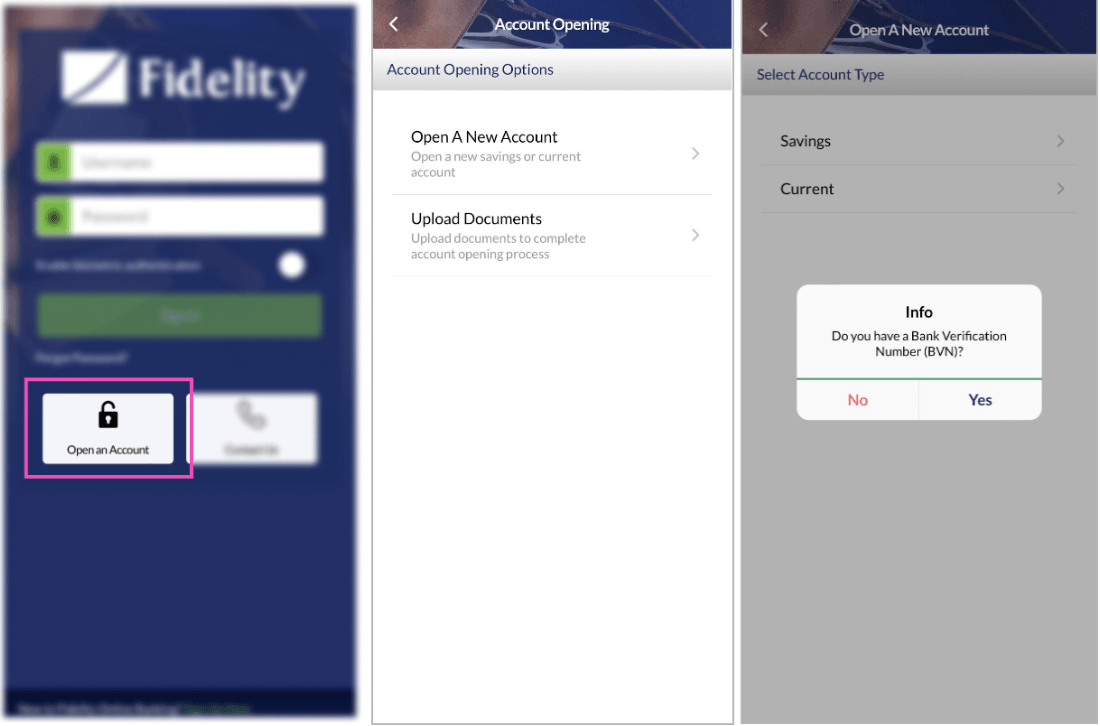

Fidelity Bank

Fidelity bank has the option to open an account on their mobile app. They also, from the onset, show the types of accounts their customers can open on the app. BVN was requested soon enough, but didn’t go through even after multiple attempts with different BVNs.

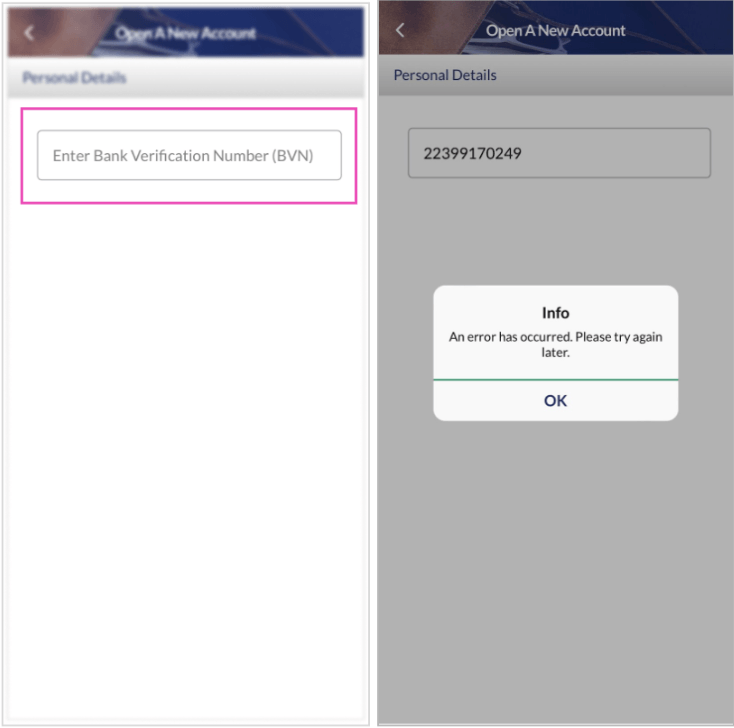

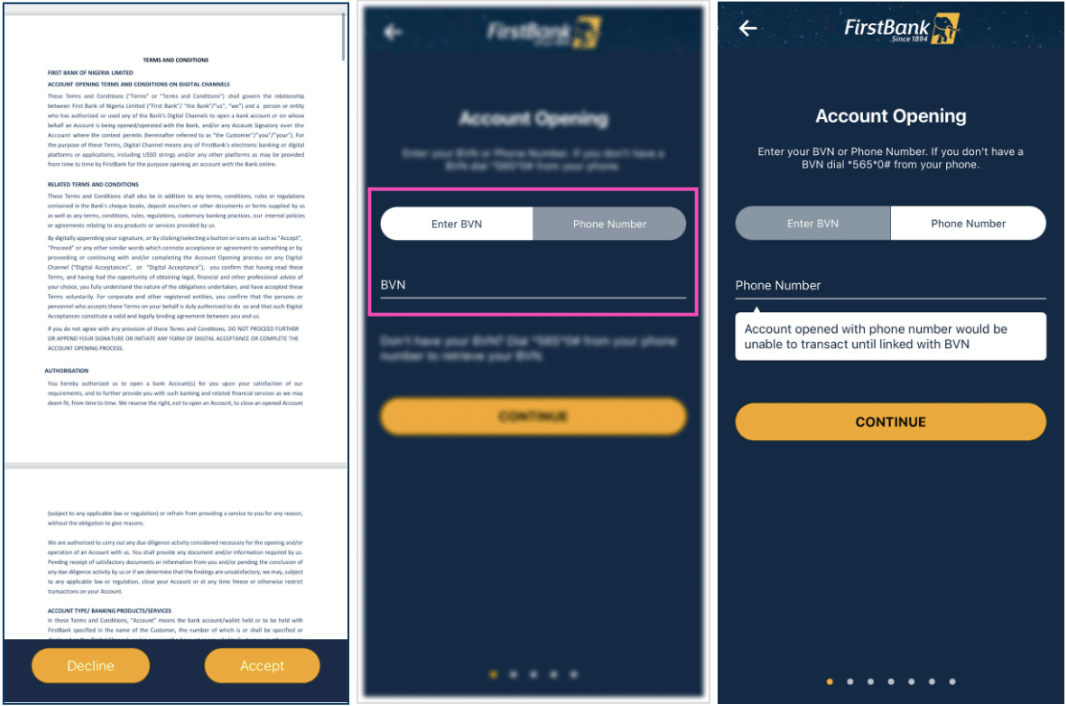

First Bank

First bank has the option to open an account on its mobile app. After the requirement of accepting its “Data Consent Form” and “Terms & Conditions”, the app requests a BVN before continuing. There is an option to use a phone number instead of BVN, but it is clearly stated that an account opened with a phone number would be unable to transact, until linked with a BVN.

Worth noting is that, at the point of this article, First bank’s mobile app failed to load the “Data Consent Form” but still required that it be ticked before progress could be made.

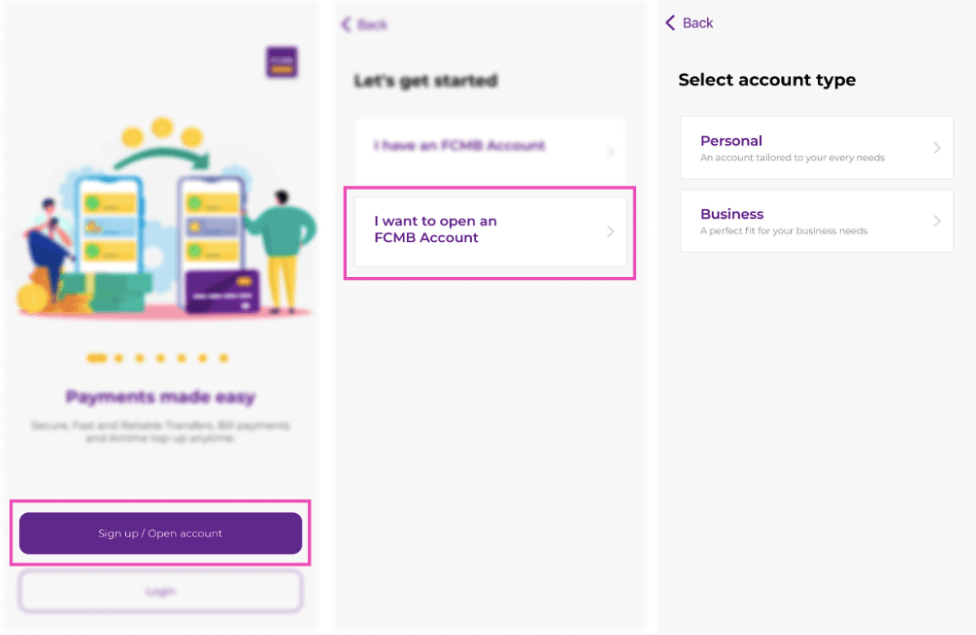

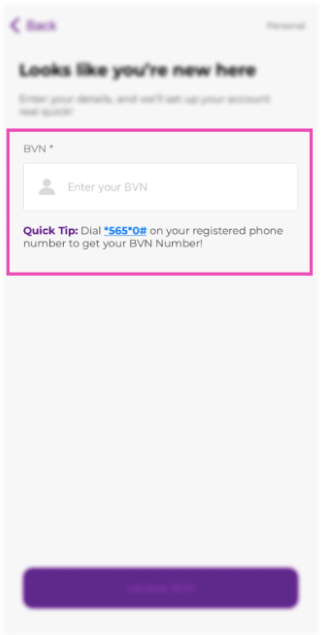

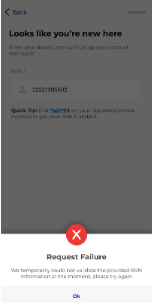

First City Monument Bank (FCMB)

FCMB has an ‘open account’ button on the first screen you land on. The bank allows a customer to open two types of accounts - personal and business. A BVN number is required once a customer chooses a personal account.

It is commendable that the bank took the extra effort to clarify that the random BVN used could not be validated.

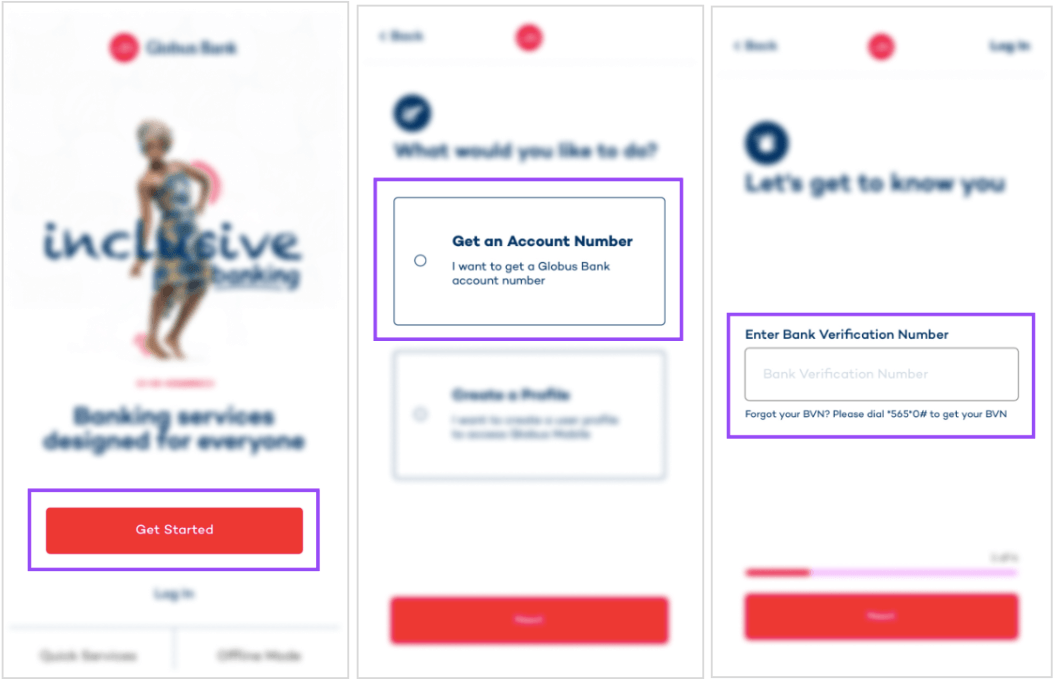

Globus Bank

After downloading Globus bank’s mobile app, one can “Get an Account Number” or “Create a Profile”. The bank promptly requests a BVN and it is commendable that the number of steps to be taken to set up the account are clearly indicated. The app also rejected a randomly generated BVN.

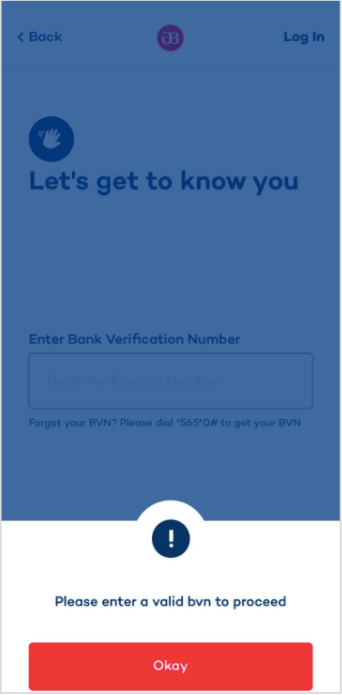

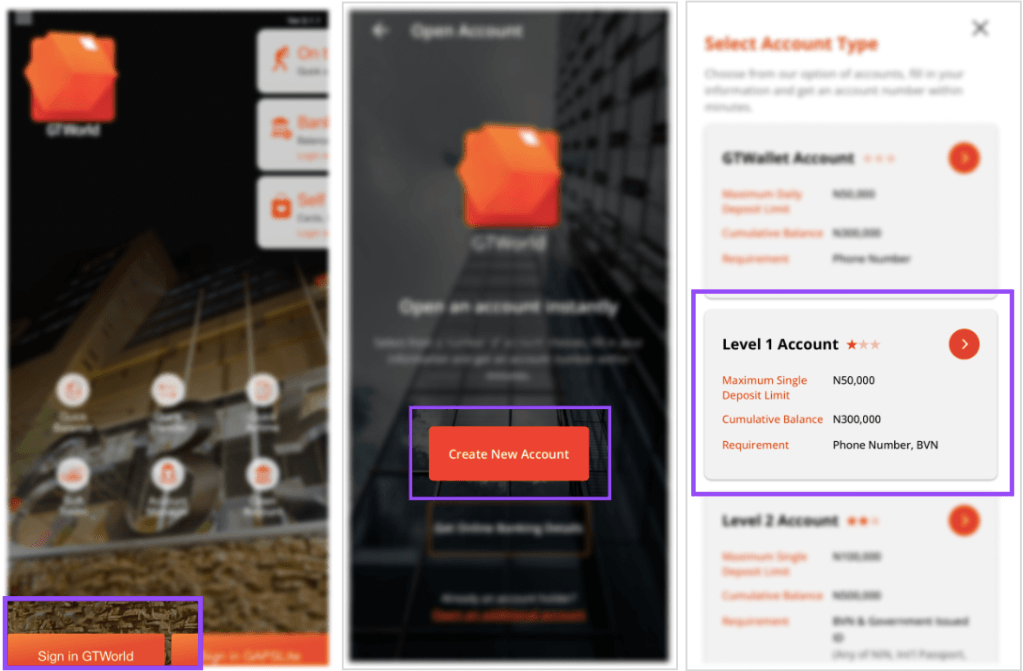

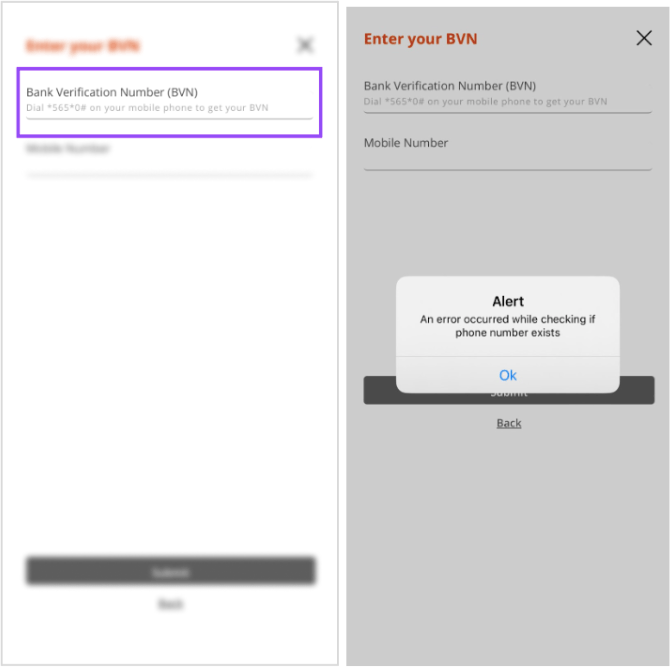

Guarantee Trust Bank

Guarantee Trust Bank (aka GTB) is arguably a youth bank. It is therefore expected that they provide top quality in their mobile app experience and still comply with CBN’s BVN policy. The bank has the option of opening an account on its first screen.

Upon continuing with that option, we are presented with a list of the types of account an intending customer may choose from. The bank offers an option that requires only a phone number and clearly states its limitations.

Although GTB does not allow fake BVNs, the feedback received always indicates an issue with the phone number entered and not the BVN, even after trying both BVN and phone number. They should be more specific.

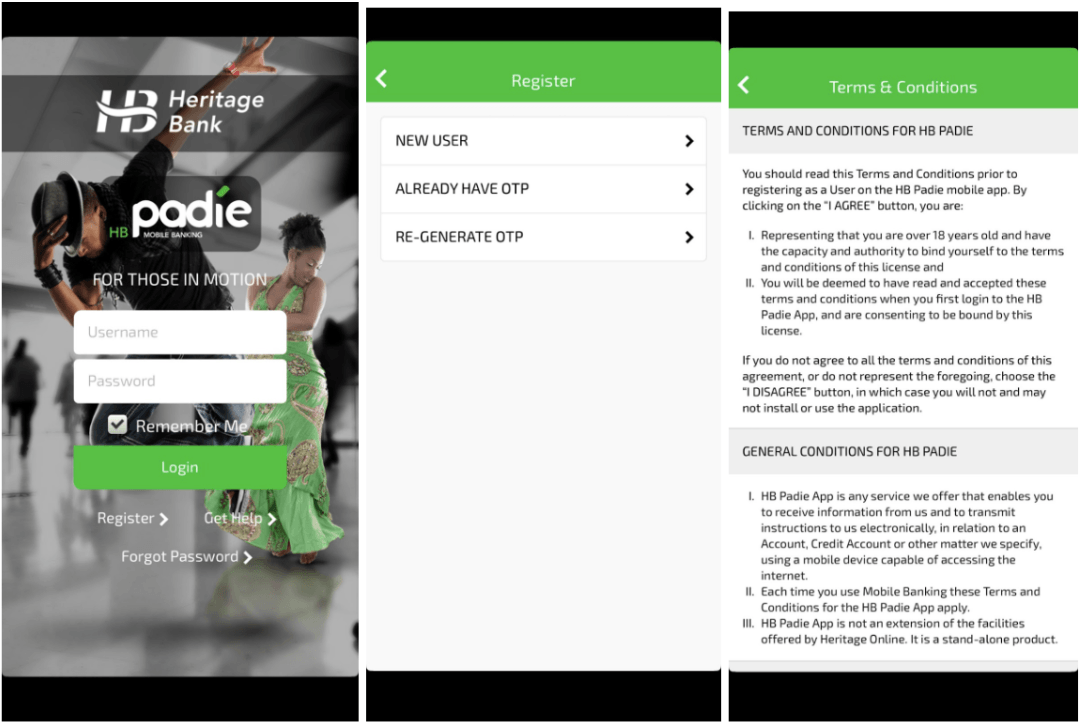

Heritage Bank

Heritage bank does not provide customers the option to open an account on their mobile app. The process requires accepting the bank’s terms and conditions before registering your existing account. This implies that to open an account, one has to go to a physical Heritage bank branch.

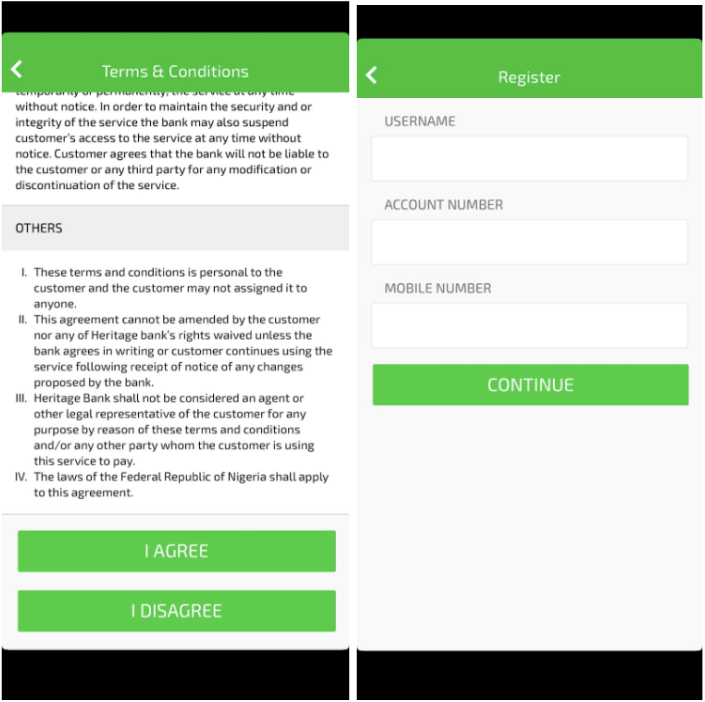

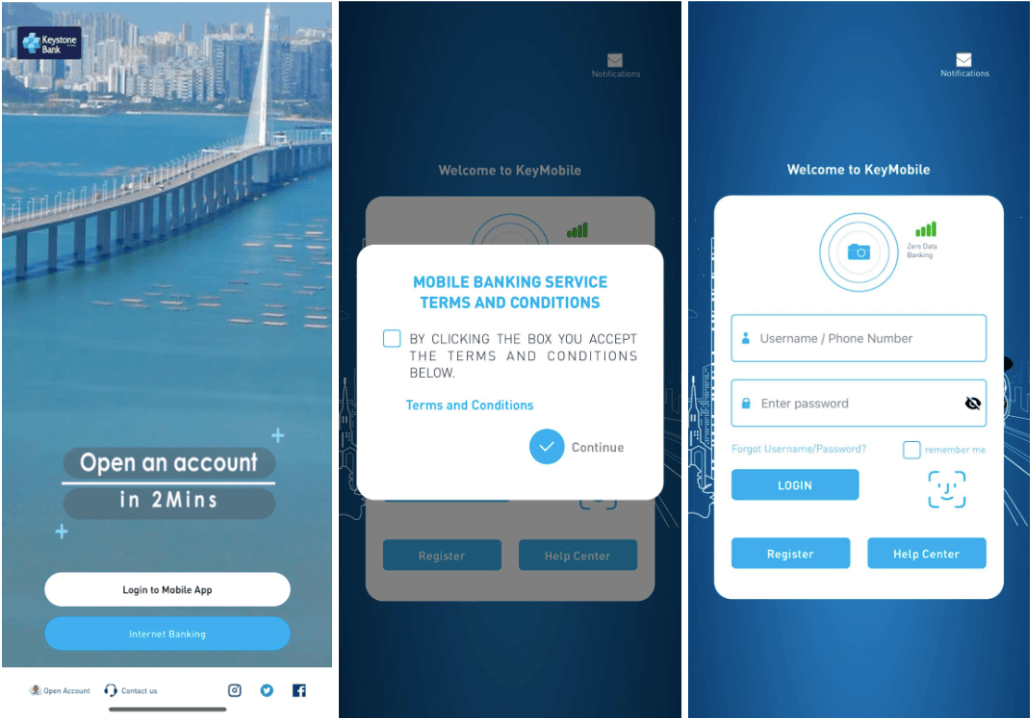

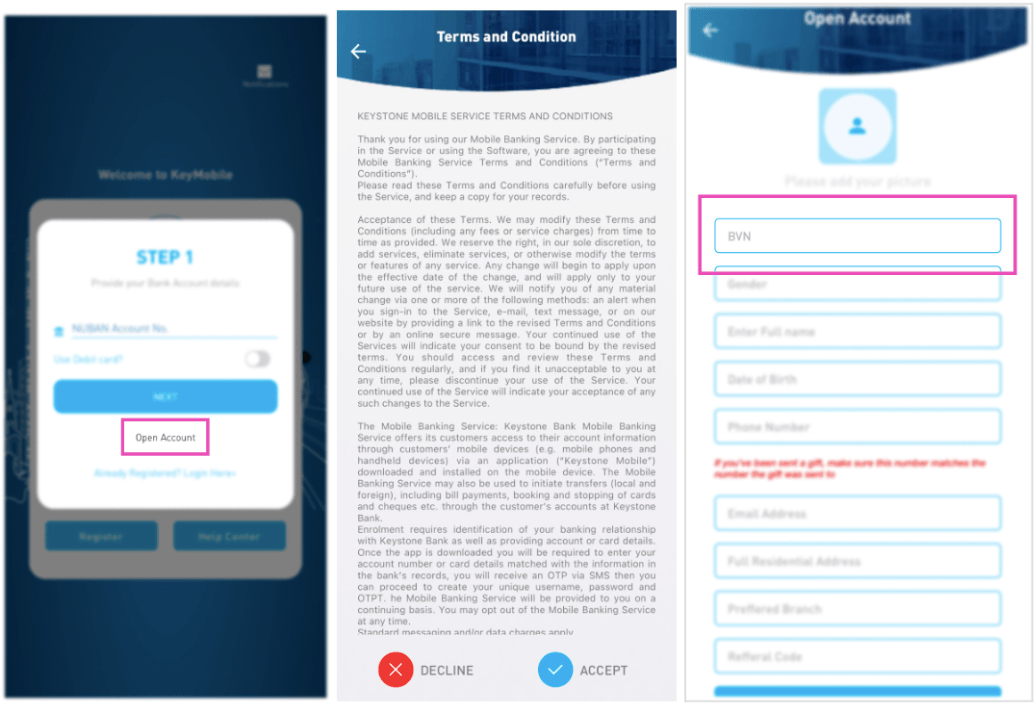

Keystone Bank

Keystone bank’s mobile app advertises “open an account in two minutes” on the first screen you land on. But the option to actually open a new account with the bank is hidden and can only be found after multiple clicks/screens.

With that being noted, Keystone bank prioritises the collection of the customer’s BVN, which is the right step to take.

Polaris Bank

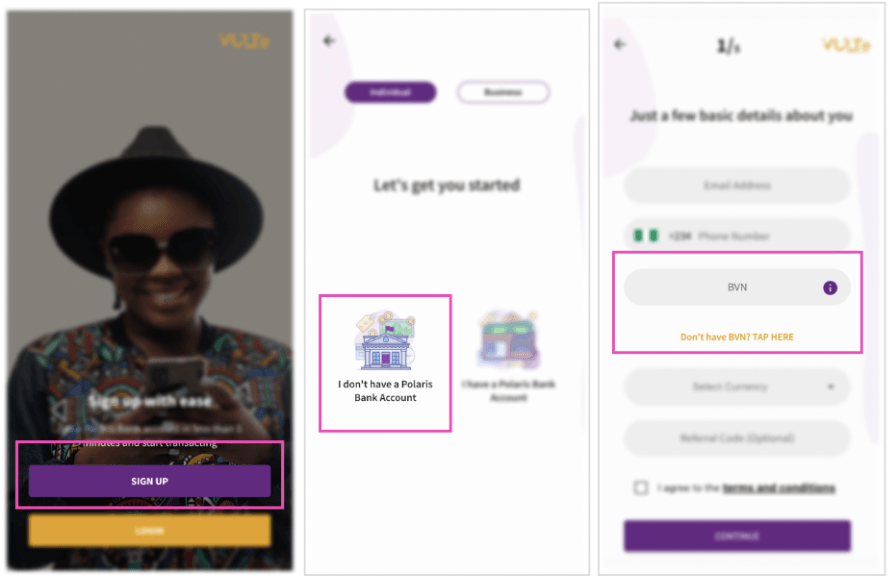

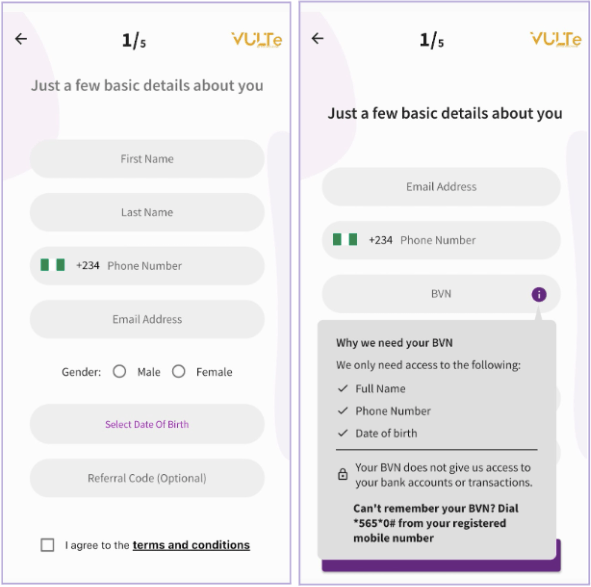

Polaris bank’s mobile app is called “VULTe”. VULTe is quite easy to find on the App Store and Google Play. When Polaris Bank is searched for, the “VULTe” app comes up. Also, a quick google search swiftly clears all doubts. Perhaps, more publicity should be done to make “VULTe” synonymous with Polaris bank.

The bank provides proper guidance to its customers and offers the option to open an account through their mobile app. They also explain the reason for requesting a BVN and its usage after the initial request, which is commendable and reassuring for the customer.

The app has an option for those who do not have a BVN, which requires the customer’s phone number. This seems to be a trend among banks - using phone numbers as a substitute for BVN.

Stanbic IBTC Bank

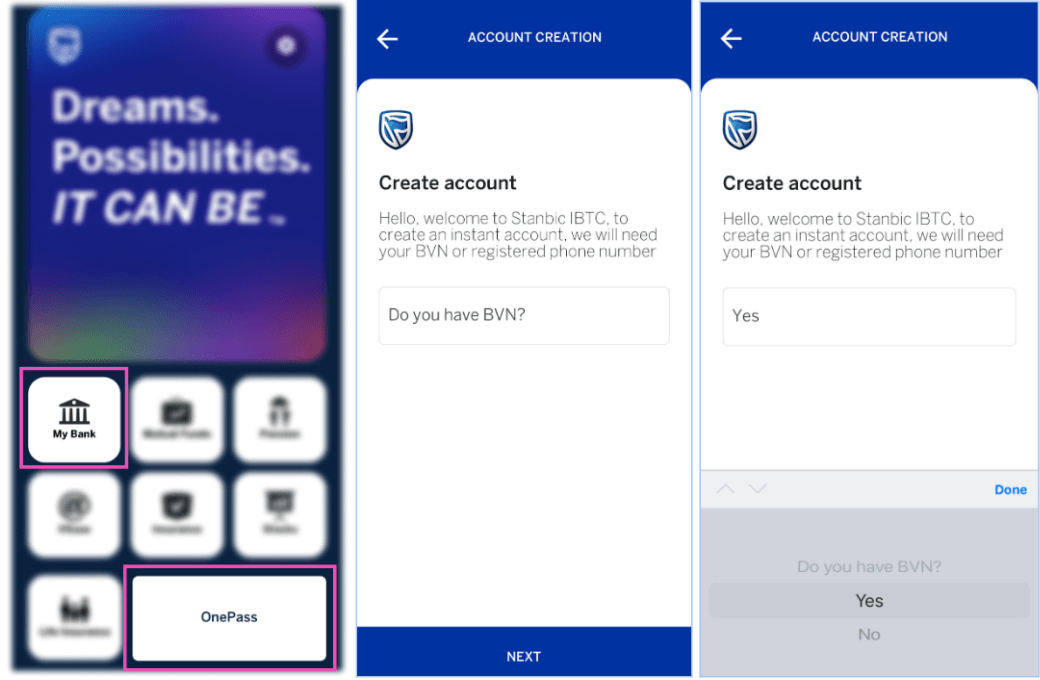

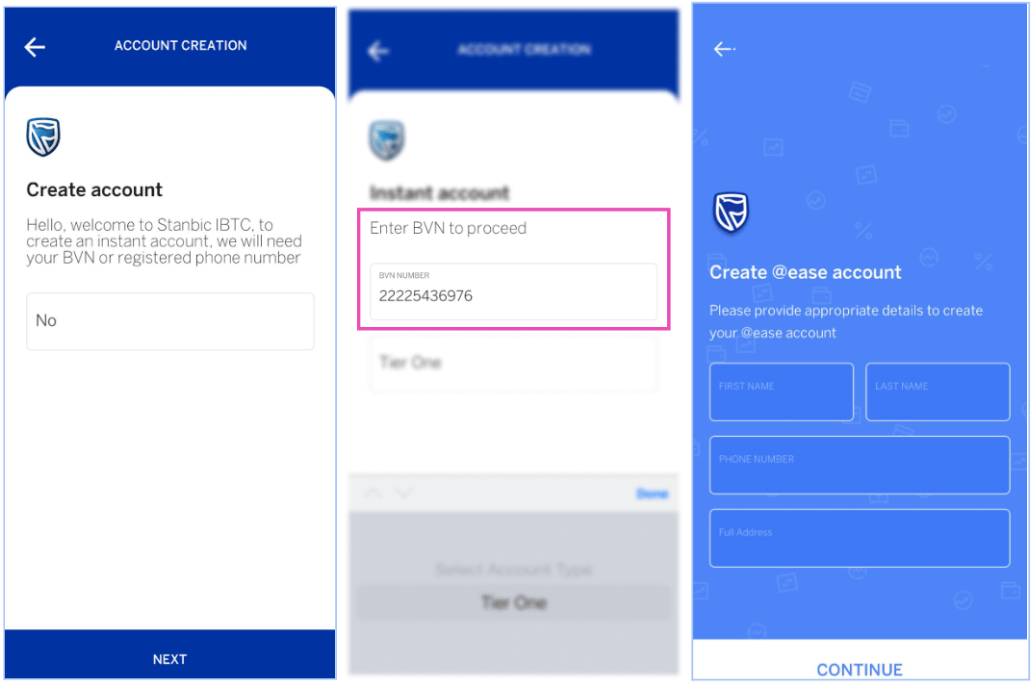

The process of opening an account with Stanbic IBTC Bank's mobile app is confusing for customers. The "open an account" button is difficult to locate and requires several steps to access. It is likened to a scavenger hunt, with different options needing to be selected before finding the desired option. Ultimately, the "open an account" button can be found by choosing either the "My Bank" or "One Pass" option.

The app provides for only one type of account called “Tier 1”. The bank also provides an alternative for customers without a BVN, and the mobile app did not provide an error message upon testing out the fake BVN, but went back to the last screen used.

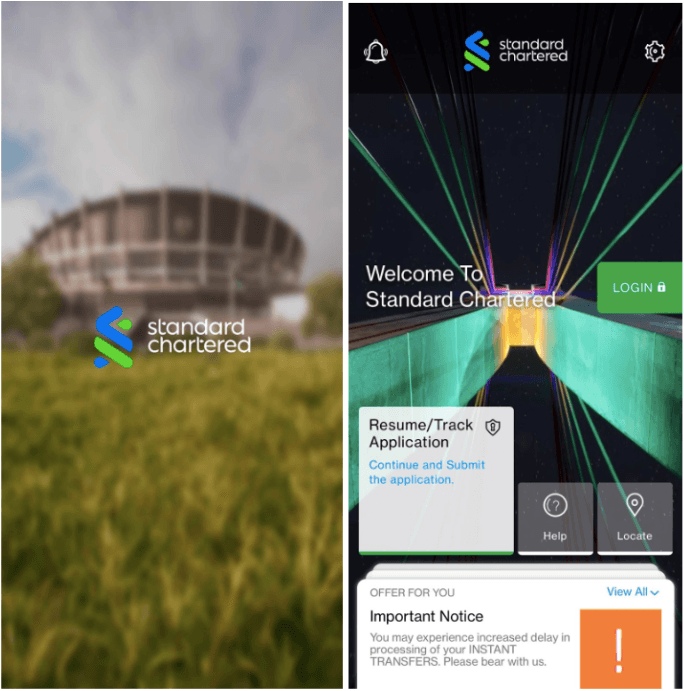

Standard Chartered Bank

As of the writing of this article, it was not possible to open a bank account with Standard Chartered Bank through their mobile app. However, it should be noted that this option has been available in the past.

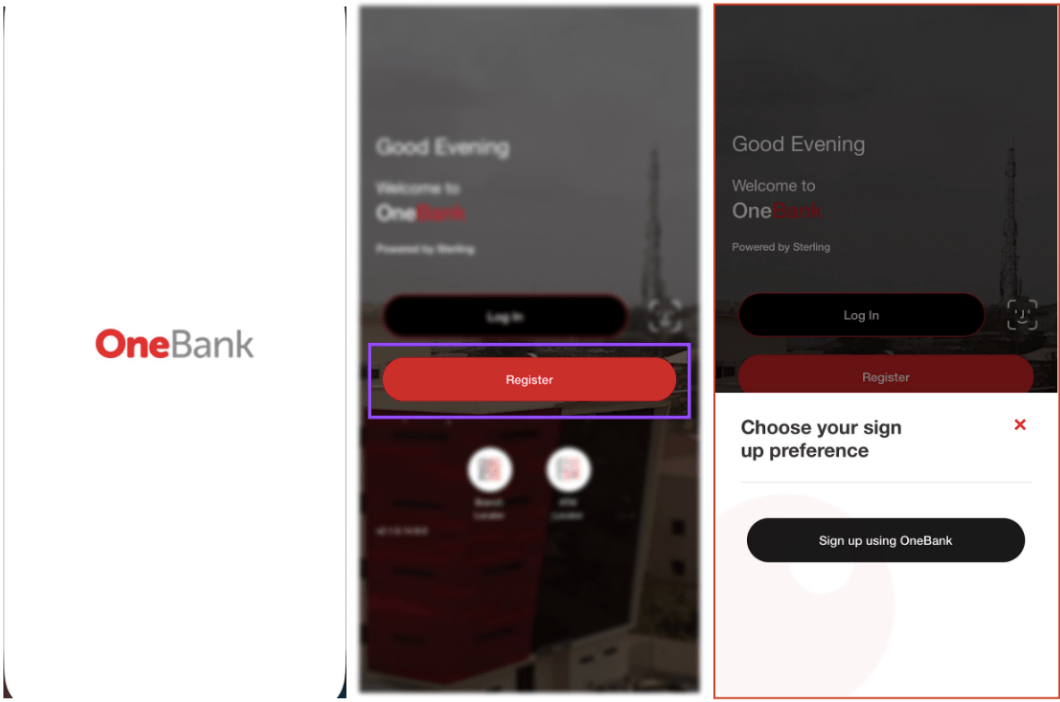

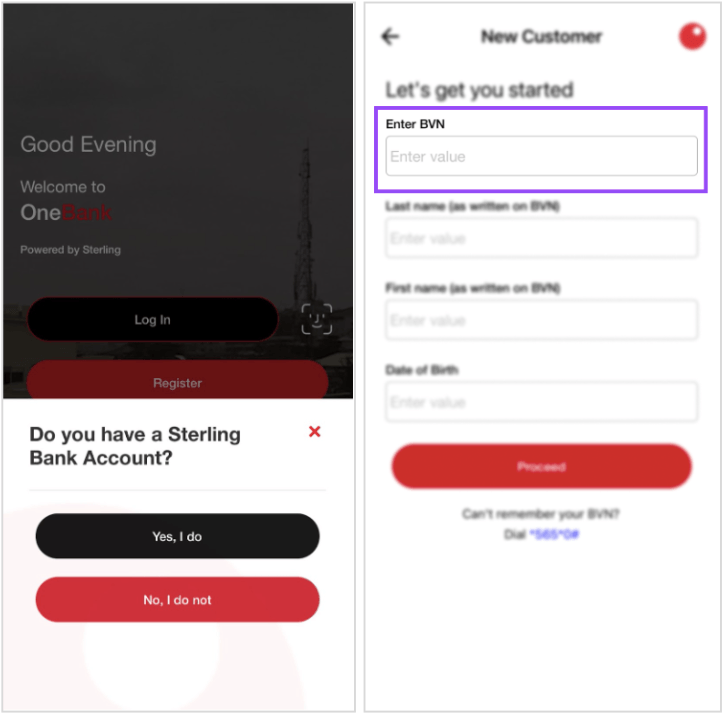

Sterling Bank

Sterling bank’s mobile app is called “OneBank” and can be easily found on the “App Store” and “Google Play”. It is worth noting how straight to the point the process for finding the “open an account button” was, and BVN was the first requirement for opening the account.

Perhaps, the name “OneBank” is familiar to existing Sterling bank customers, it shouldn’t be assumed that intending customers would know this. More publicity should be made, to associate “OneBank” with Sterling bank.

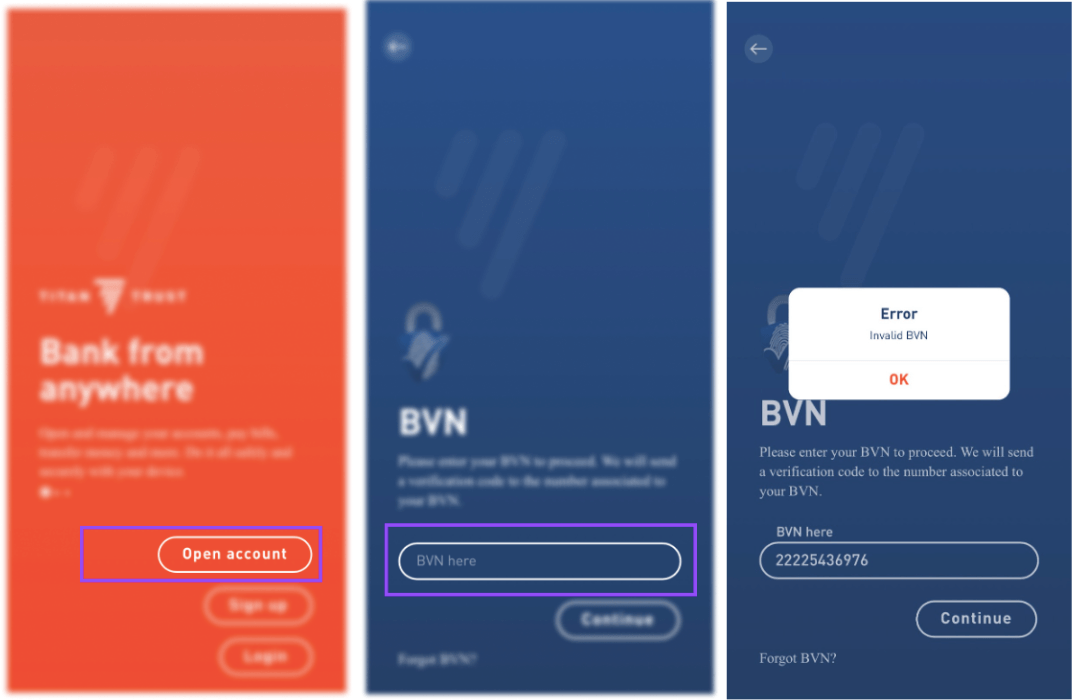

Titan Trust Bank

Titan Trust Bank's mobile app offers the option to open a bank account, with the "open account" button located at the top of the first screen. Upon proceeding to the next screen, the customer is prompted to provide their BVN. In the event that a fake BVN was used, an error message reading "Invalid BVN" was generated. Compared to the other banks examined, Titan Trust Bank's mobile app has the shortest process leading up to the BVN requirement.

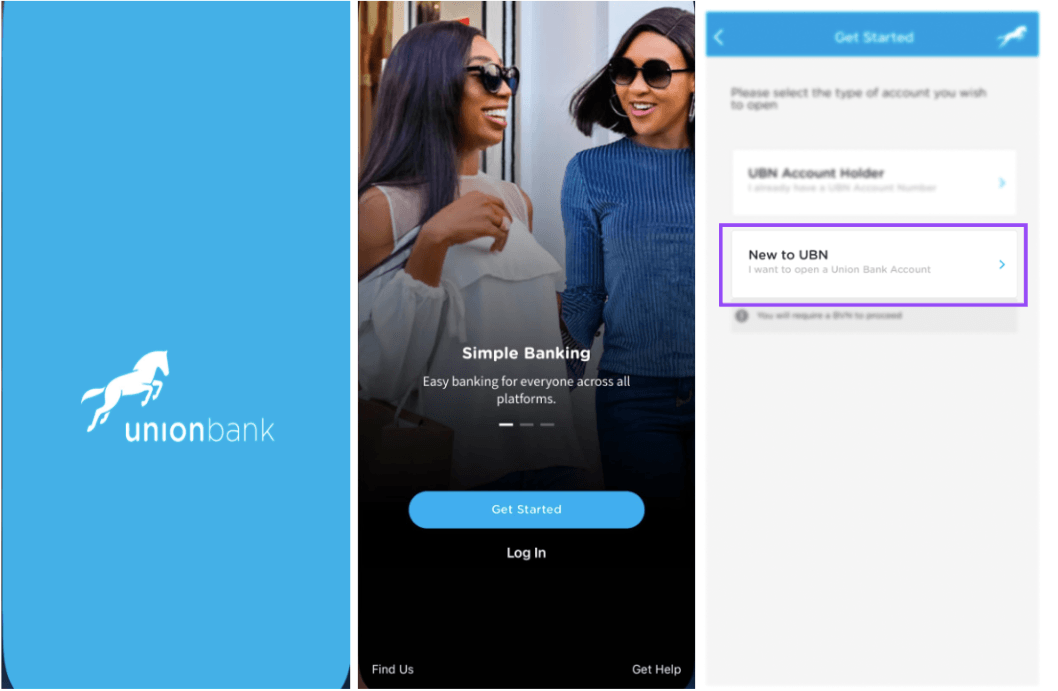

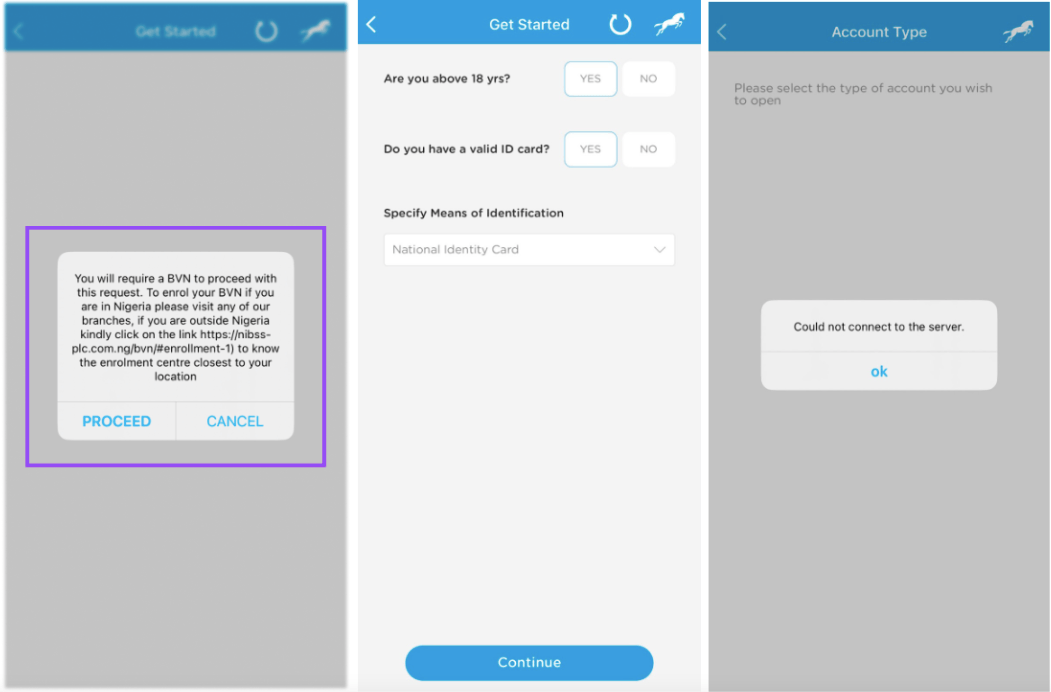

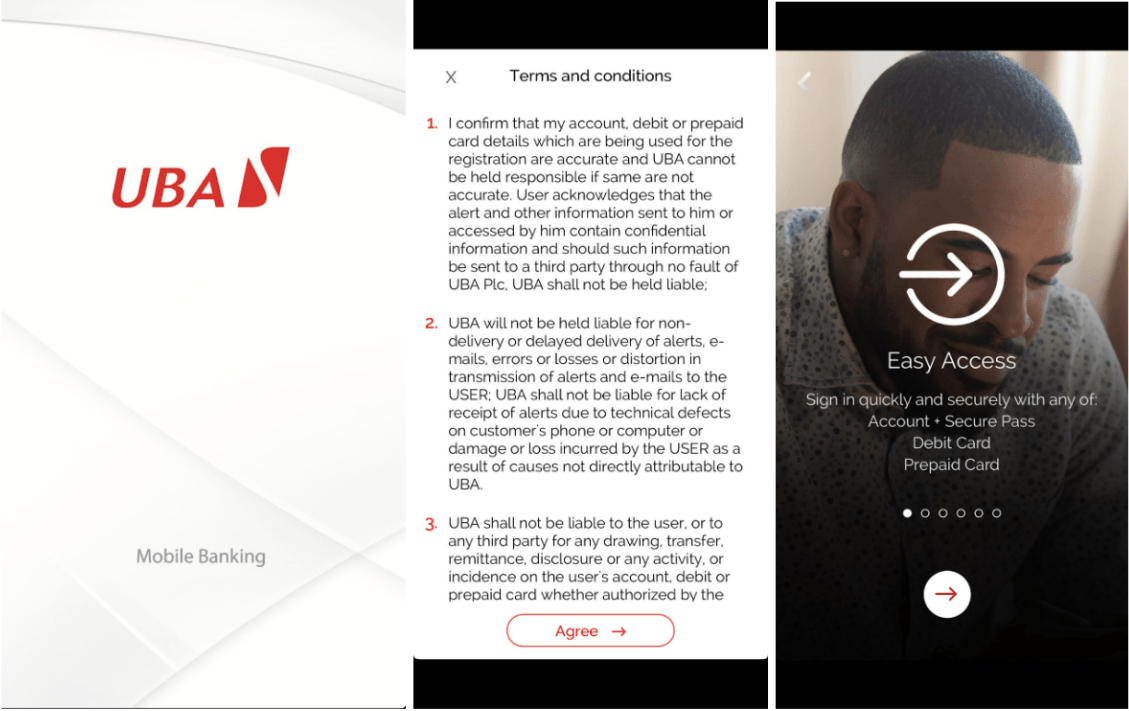

Union Bank

Union Bank's mobile app offers the option to open a Union Bank account, with the importance of having a BVN stated upfront. The customer is prompted to answer questions about their age and provide a valid ID, to which they can select "yes," "no," or the ID type.

However, the process is interrupted before the customer can input their preferred account type and actual BVN, as an error message appears, stating "could not connect to the server.

The app usage experience was problematic as it required loading after each action to proceed to the next screen. This process continued until it eventually displayed a "could not reach the server" notification.

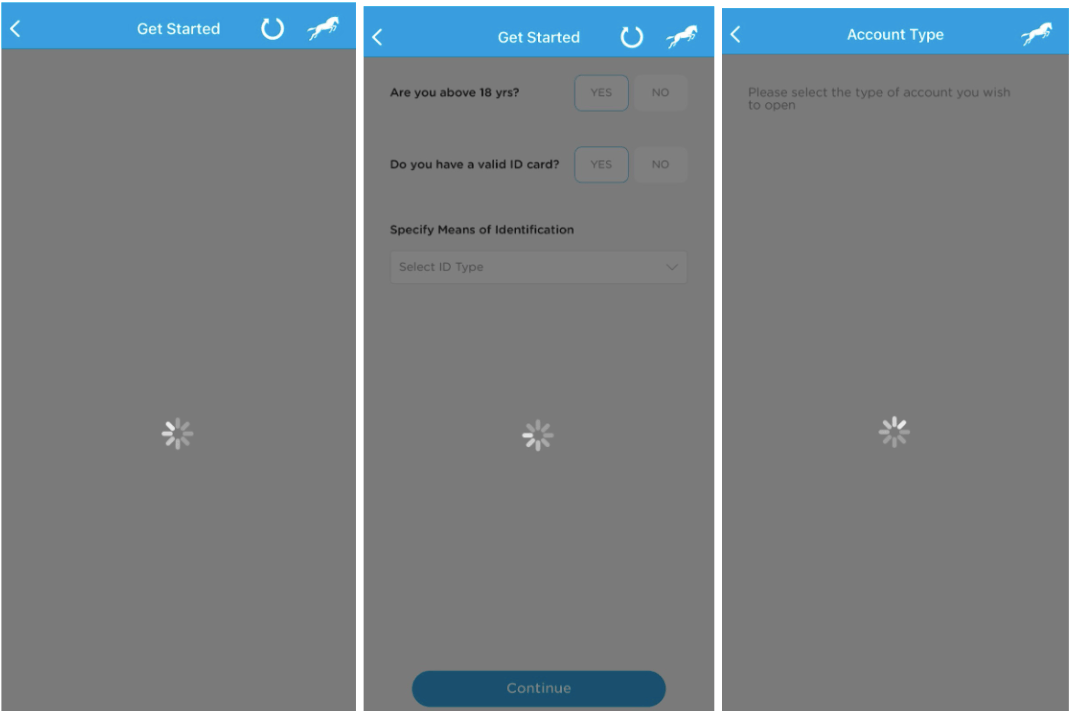

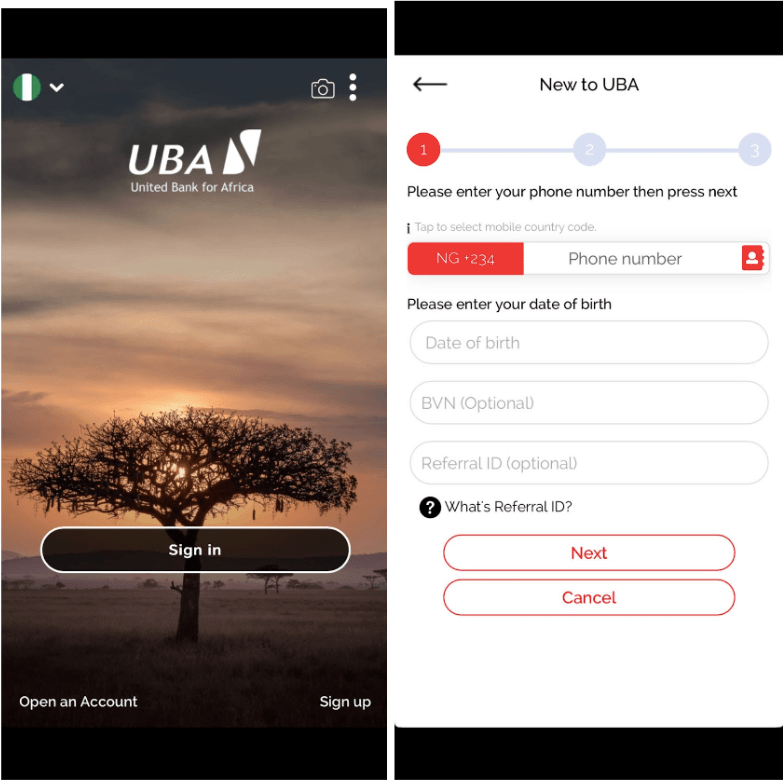

United Bank of Africa (UBA)

UBA's mobile app mandates its customers to accept its terms and conditions before accessing its content. The app has an option to open a new account, but upon selecting the account type, the form screen indicates that providing a BVN is optional while a phone number is compulsory.

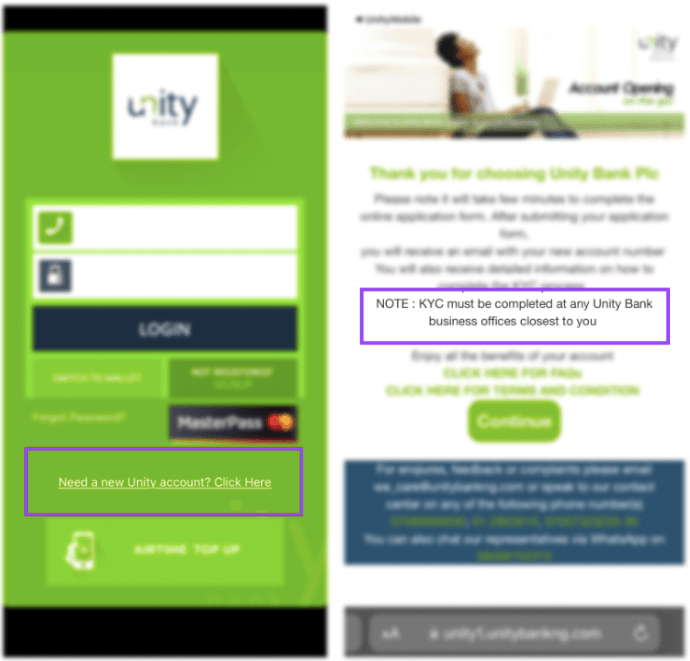

Unity Bank

Unity Bank does not offer the option to open an account through its mobile app, even though the "Open Account" button is present on the first screen. Clicking on it redirects the user to the phone's browser, where they are then instructed to visit a physical branch to open the account.

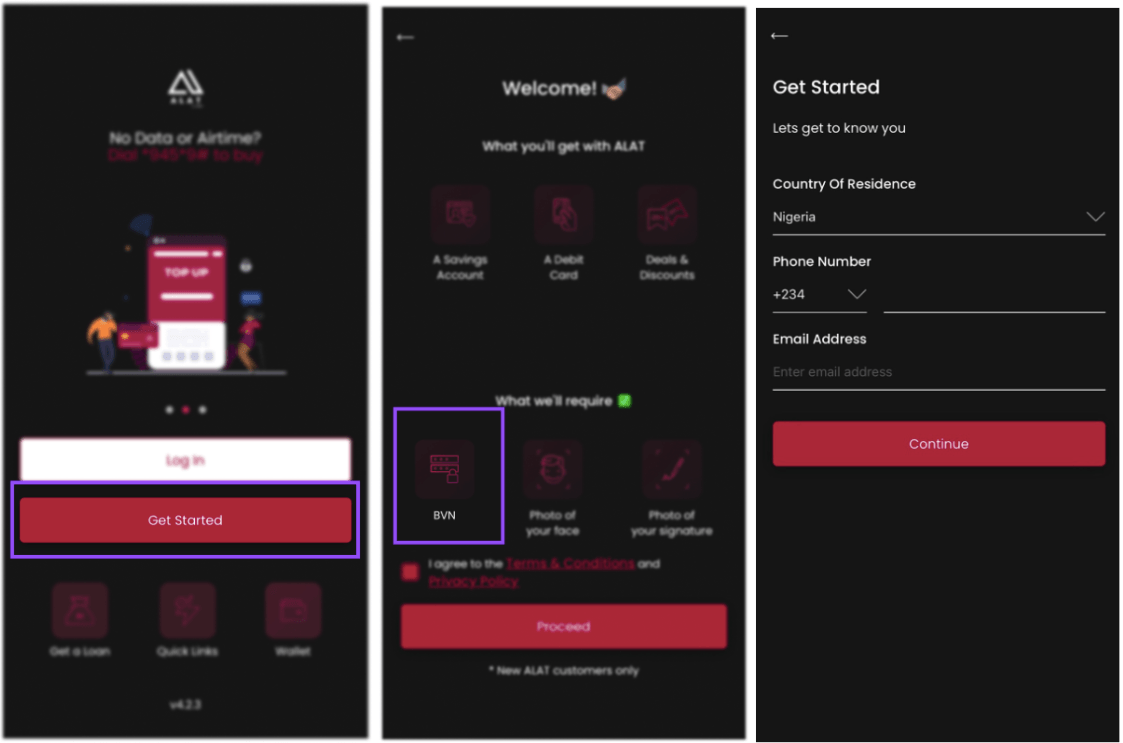

Wema Bank

Wema bank’s mobile app is called “ALAT”by Wema. The application allows a customer to open an account but requires an agreement to the bank’s terms and conditions. The app also provides information about the benefits of opening an account with Wema Bank and the requirements for opening the account. BVN is listed as the first requirement for opening a bank account with Wema Bank.

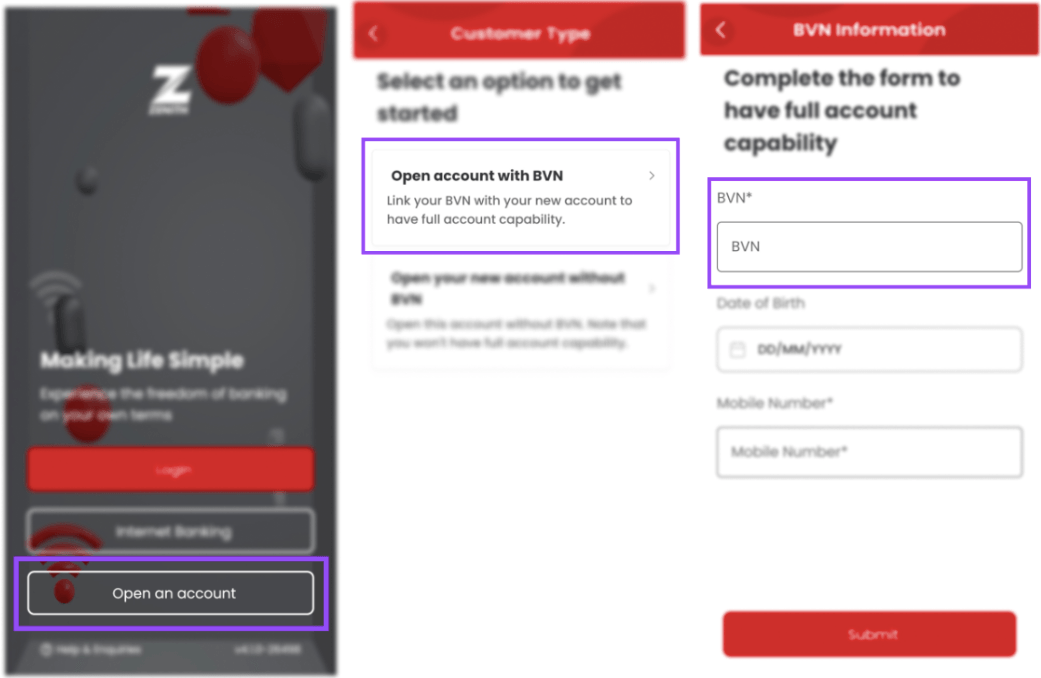

Zenith Bank

Zenith bank's mobile app provides customers with the option to open an account, which can be found on the first screen of the app. The bank app provides two options: opening an account with BVN and opening an account without BVN. It warns the customer that the option without BVN won't have full account capability.

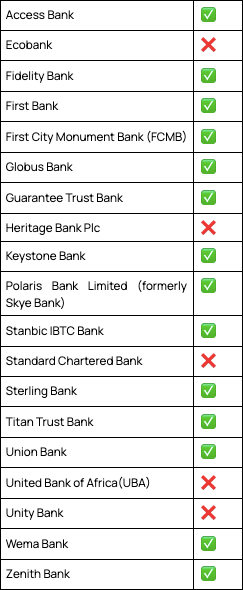

Here is a summary of banks that comply with the requirement of allowing customers to open an account via their mobile app and how quickly they verify the customer's BVN before granting access to banking services.

Conclusion

The majority of banks appear to have implemented the CBN's Bank Verification Number policy in their institutions and have included the option to open a new account on their mobile apps. However, the actual process of opening a new account through these apps is often unsuccessful and may be too lengthy, causing customers to abandon the process or opt to open an account in-person at a bank branch.

Which bank allows freezing accounts and cards on their mobile app?

Waiting for feedback

Which bank’s mobile apps have been reliable - especially during the pre-election period in February 2023?

The Nigerian population has been plunged in an unexpected and unprepared cashless living situation. The Central Bank of Nigeria (CBN) introduced new Naira notes which were distributed to commercial banks, however, there were issues with the dispensing of these new notes by the banks to the public, resulting in many ATMs being out of cash.

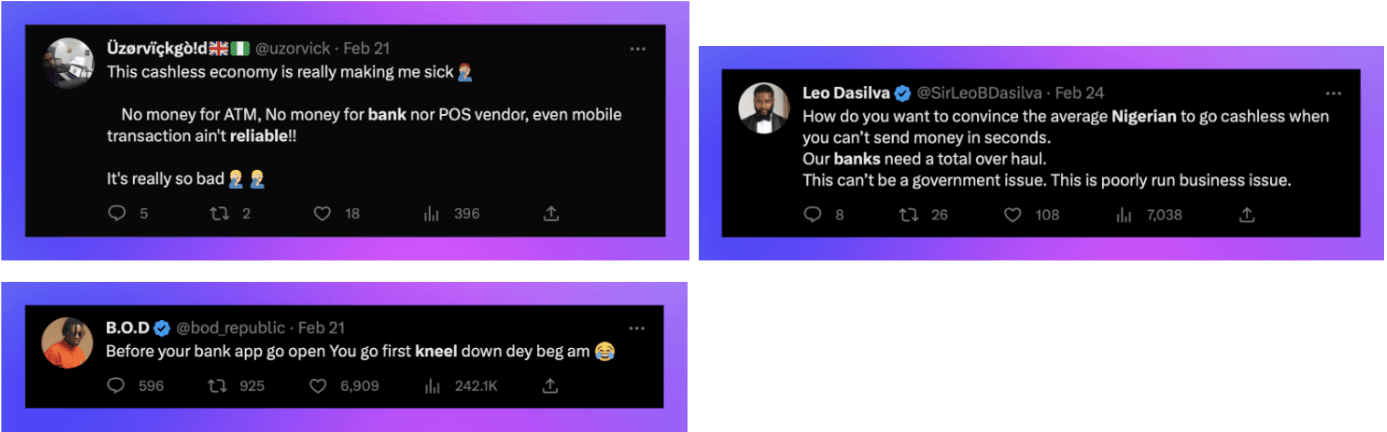

Due to the cash shortage in Nigeria, citizens are left to rely heavily on digital banking due to inadequate distribution of new Naira notes by commercial banks. Some individuals have had to resort to purchasing cash from Point of Sale (POS) agents who charged high fees for their services. The charges for the new Naira notes became more expensive than the old notes, leading to further challenges for citizens. As a result, many people had to rely on card payments or transferring money through their mobile banking apps, which were also facing reliability issues.

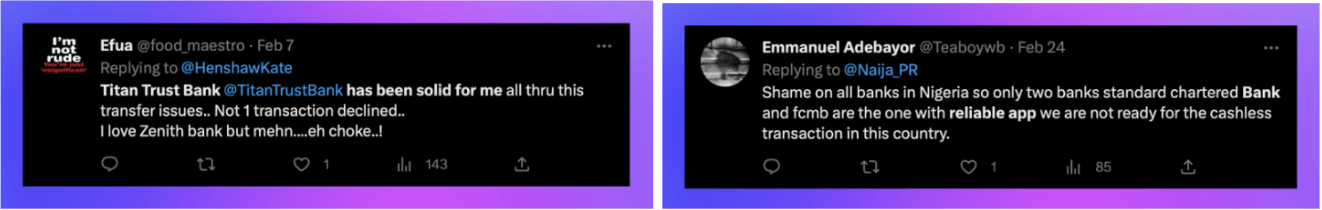

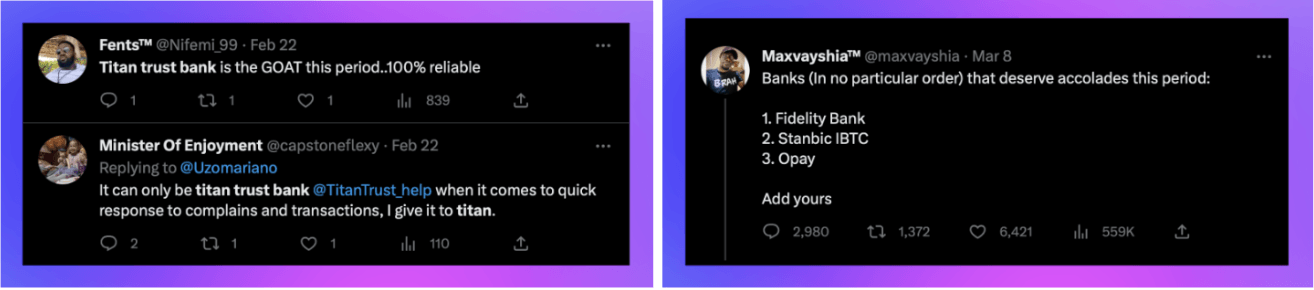

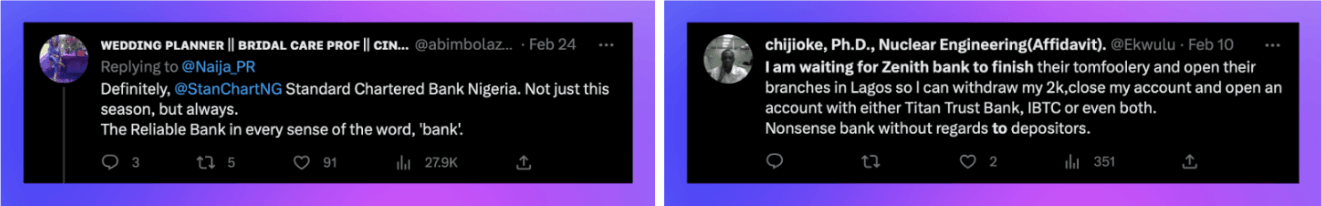

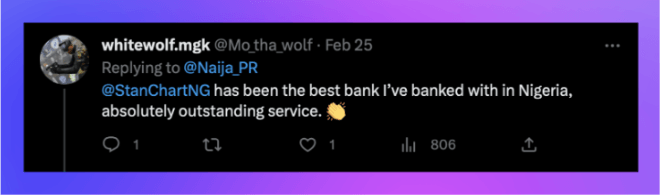

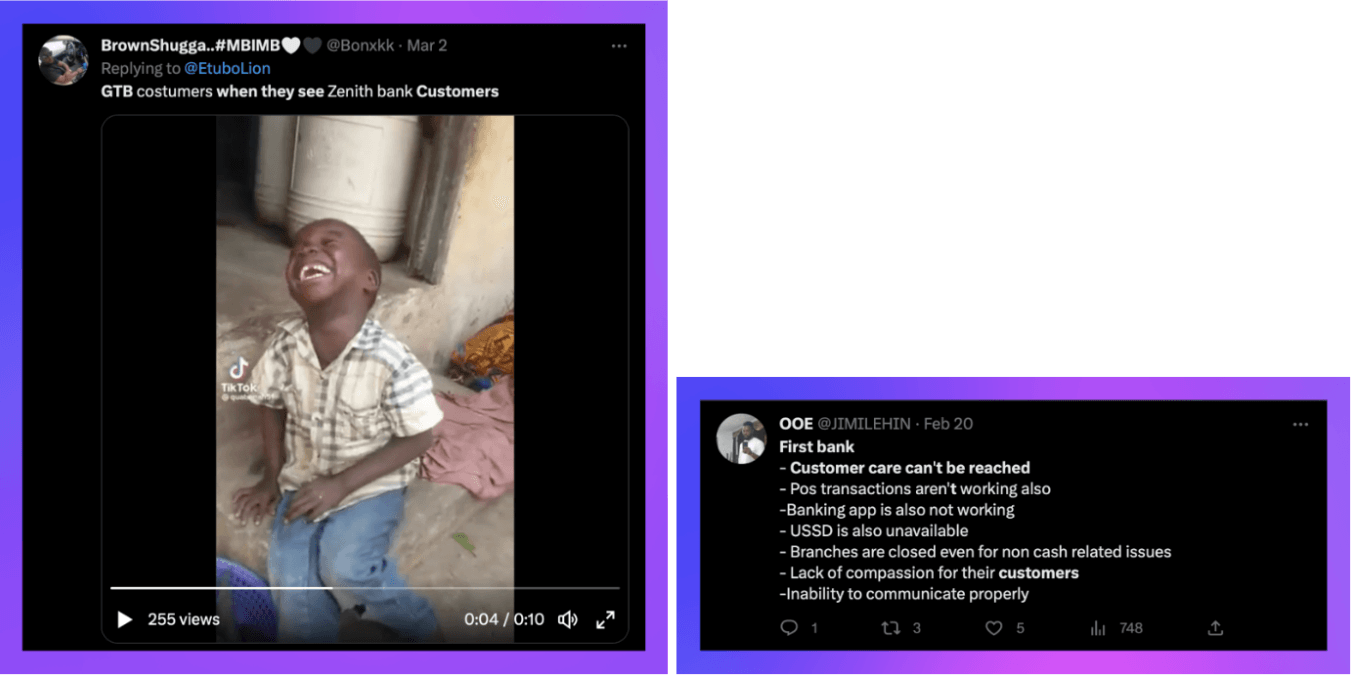

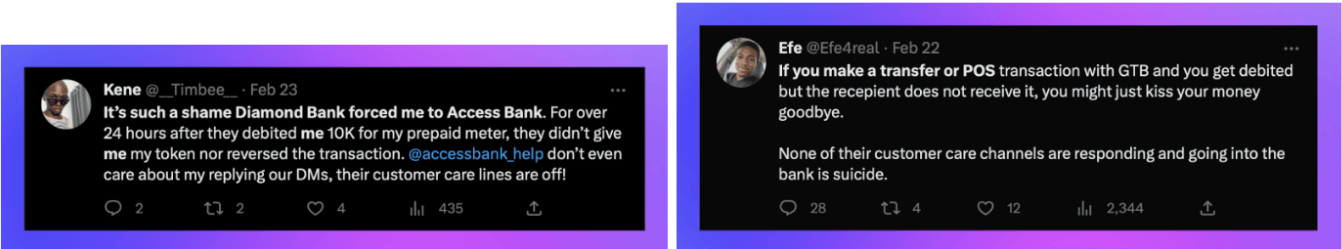

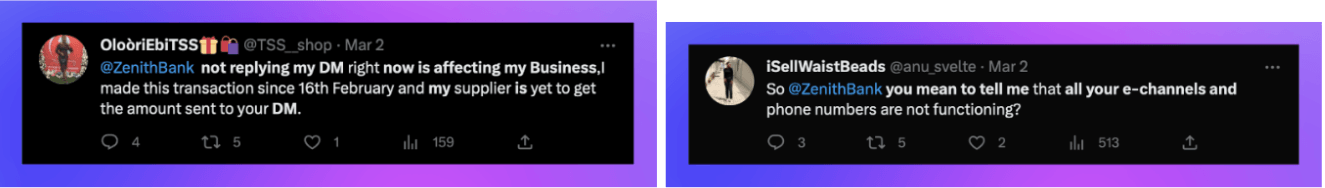

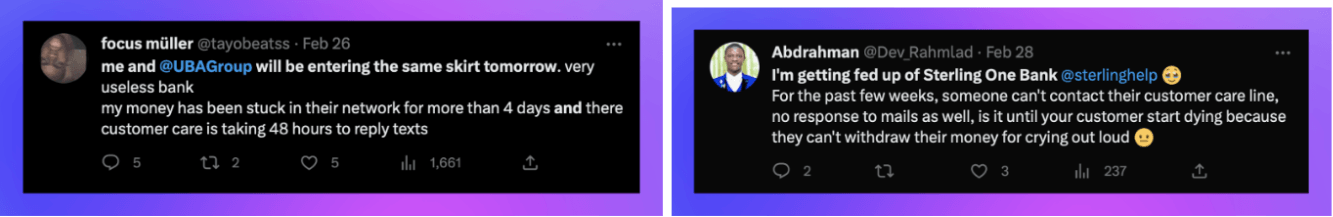

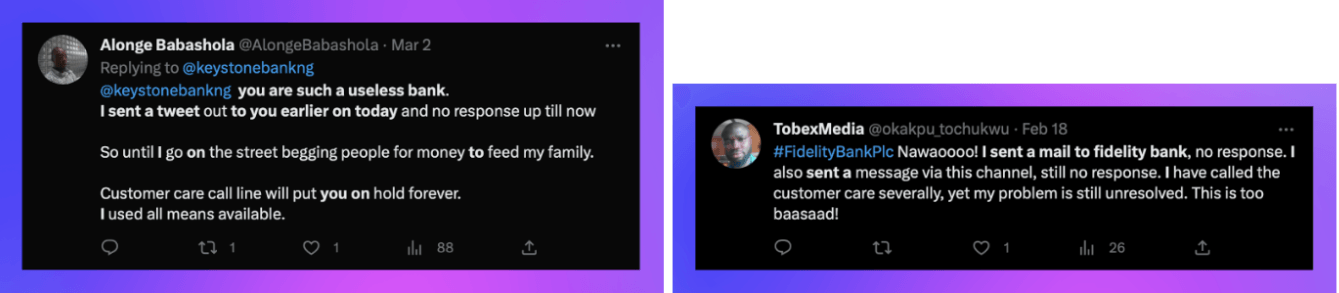

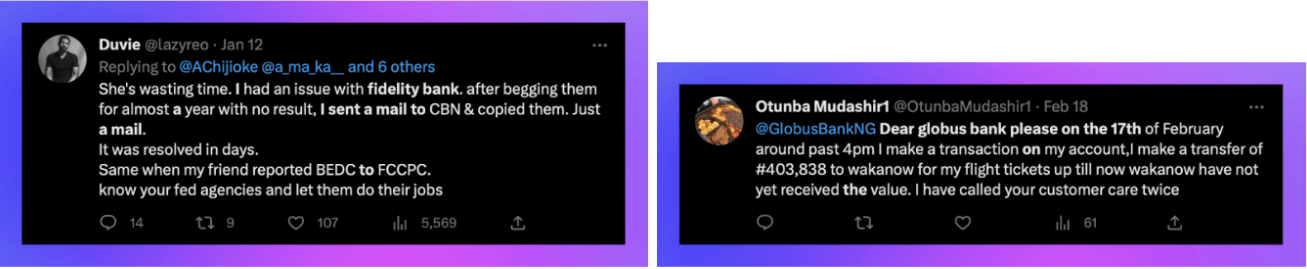

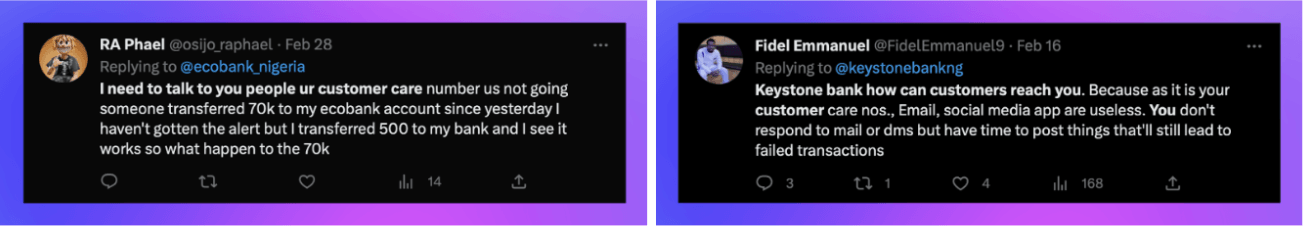

The situation took a nosedive after the deadline for exchanging the old naira notes passed. The already strained cashless economy faced even more challenges with the reduced circulation of cash. Many people had to rely on digital payments for essential everyday needs, but unfortunately, the system crashed. Frustrated customers took to Twitter to express their grievances and file complaints. See below a few of those:

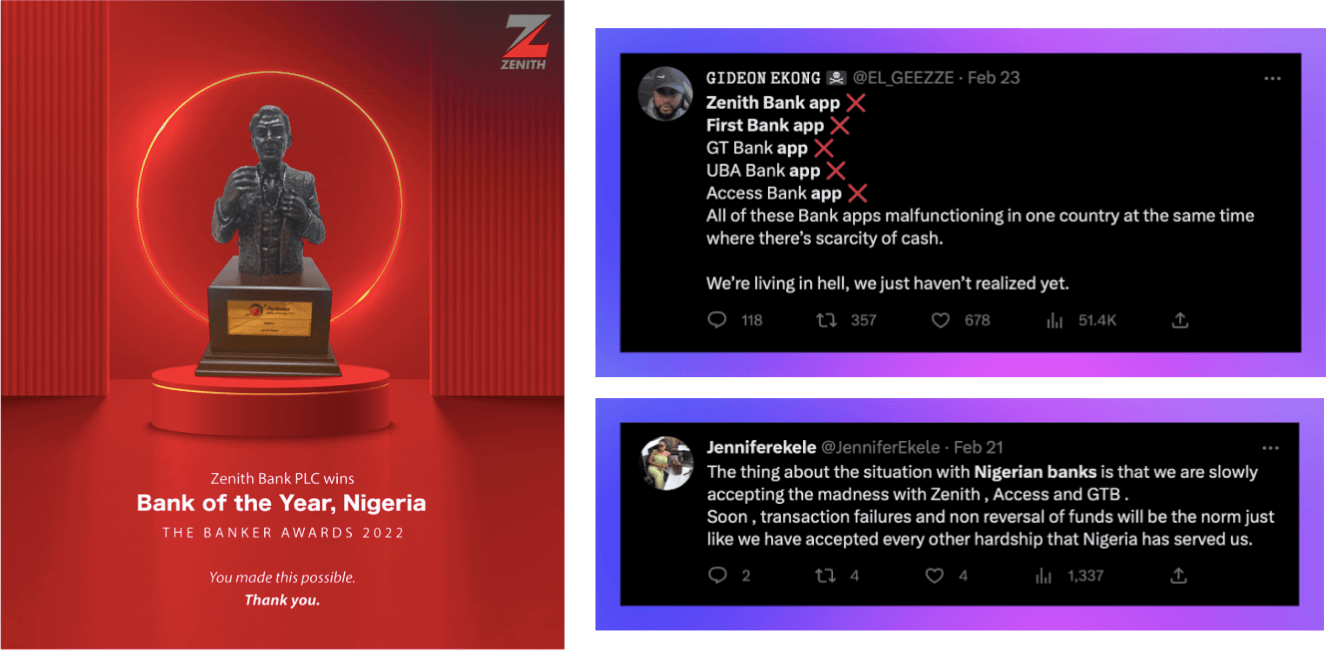

Before the cash crisis, some banks such as GTBank, Access Bank, and UBA had already faced criticisms, but Zenith Bank's recent unreliability is surprising and unfortunate, especially since the bank was awarded "Bank of the Year, Nigeria" in 2022.

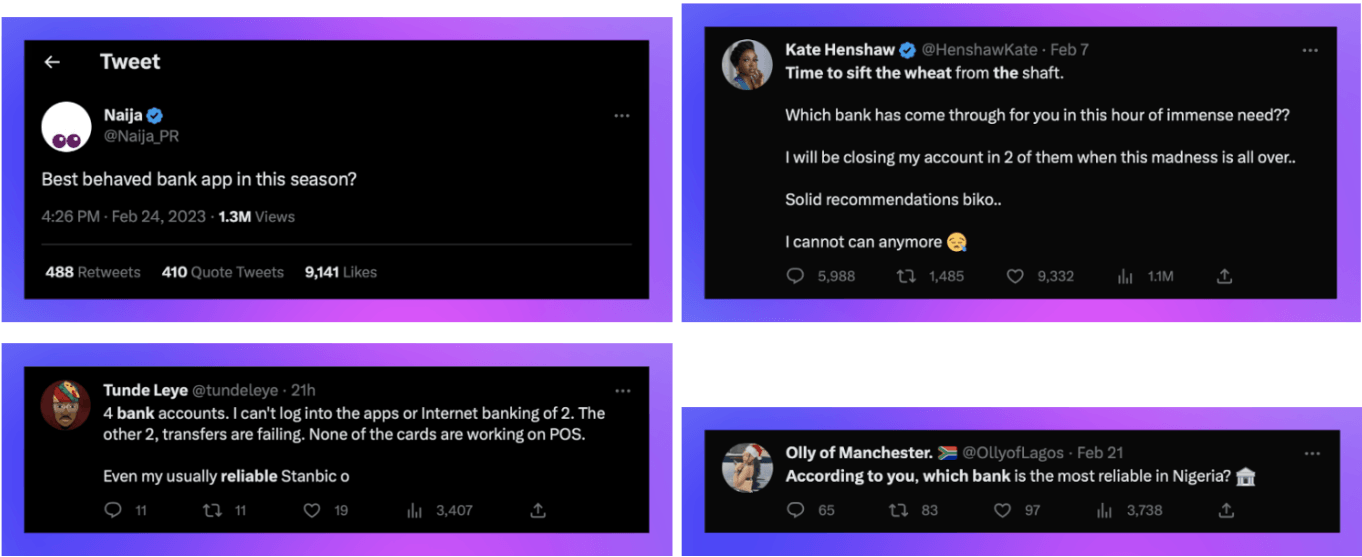

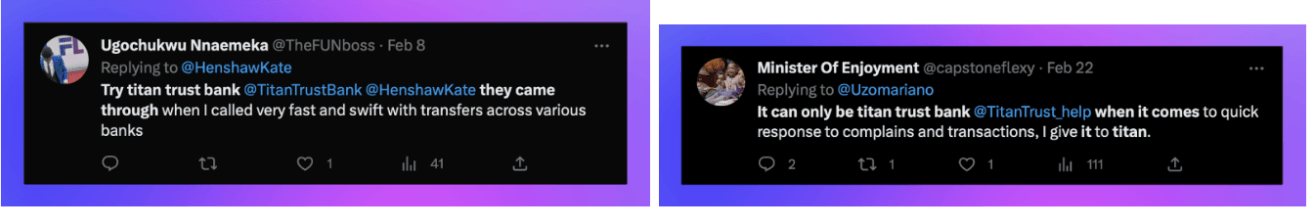

The cash crisis led to a lot of people seeking out reliable banks for digital banking, as most banks could not keep up with the extra load, even the ones that were previously pulling their weight.

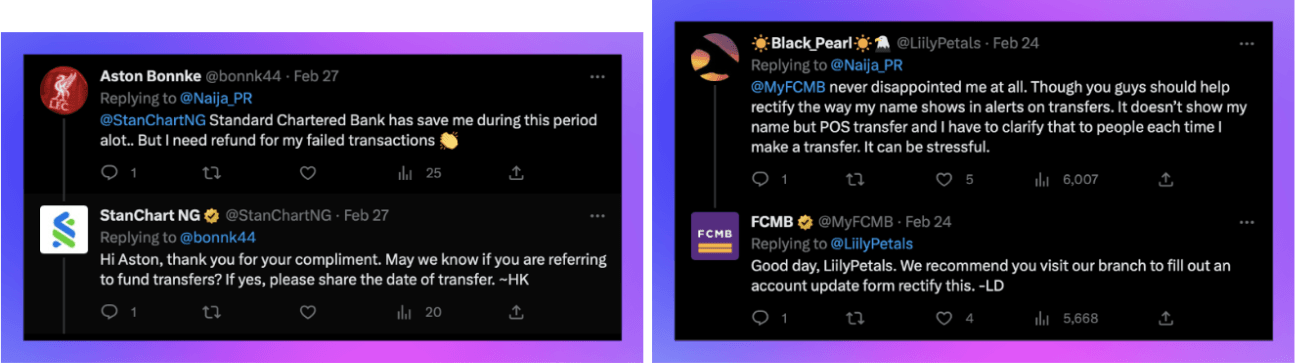

Which banks were considered reliable? Titan Trust Bank, Standard Chartered Bank and First City Monument Bank were considered reliable, as they clearly stood out with the most recommendations from people. Fidelity Bank, Stanbic IBTC and even OPay made notable appearances.

Rating Nigerian bank’s customer service

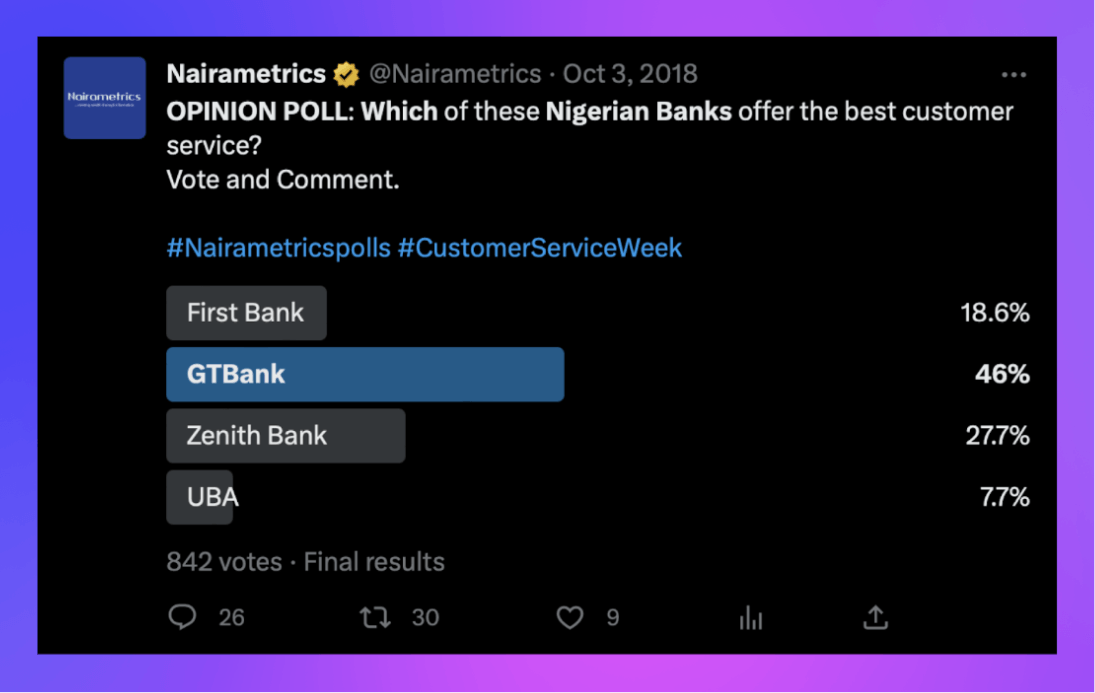

Nigerian banks as a rule of thumb offer self-care or customer support options within their mobile applications. However, there are concerns regarding the effectiveness of these provisions as many customers still resort to Twitter to voice their complaints about their bank's services. This trend began a few years ago and banks have since mandated their representatives to quickly resolve or manage these complaints on Twitter through mentions and Direct Messages (DMs). Guarantee Trust Bank was particularly efficient in this regard, earning recognition at the time.Here’s a poll from October 3, 2018.

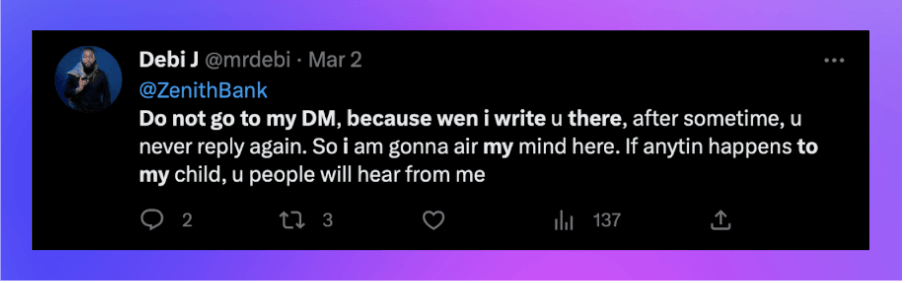

In recent times, there has been an increase in the number of complaints from customers directed towards Nigerian banks on Twitter. Unfortunately, the banks in question seem less responsive to these complaints, with the general trend being to deflect with a general apology or wait for the situation to blow up before addressing it. It is possible that this lack of responsiveness is due to the law of diminishing returns. The banks that have been frequently mentioned in these complaints are Guarantee Trust Bank, Access Bank, UBA, and Zenith Bank. Customers have been voicing concerns about issues such as failed transactions without a reversal, wrong debits, and the lack of effective response or solution from the bank's customer care staff online. Additionally, long queues at the bank have also been a common issue for customers seeking to sort out their banking problems.

Zenith Bank's recent decline in reputation has been surprising to many Nigerians who once regarded it as an elite bank. Lately there have been multiple reports of missing funds from customers' accounts in both local and domiciliary accounts. As a result, there has been an increase in viral tweets advising people to withdraw their funds from the bank, which has negatively impacted the bank's image. This issue was a hot topic in the banking space before the unexpected cash shortage crisis occurred.

Some banks have established a strong customer service presence on Twitter, allowing customers to easily connect with representatives to address their concerns or issues. Below are some examples:

The table below has been drawn to rate the customer support service of some of these banks. 5 stars being great and 1 star being poor.

The reality of using challenger banks in Nigeria - how reliable have they been?

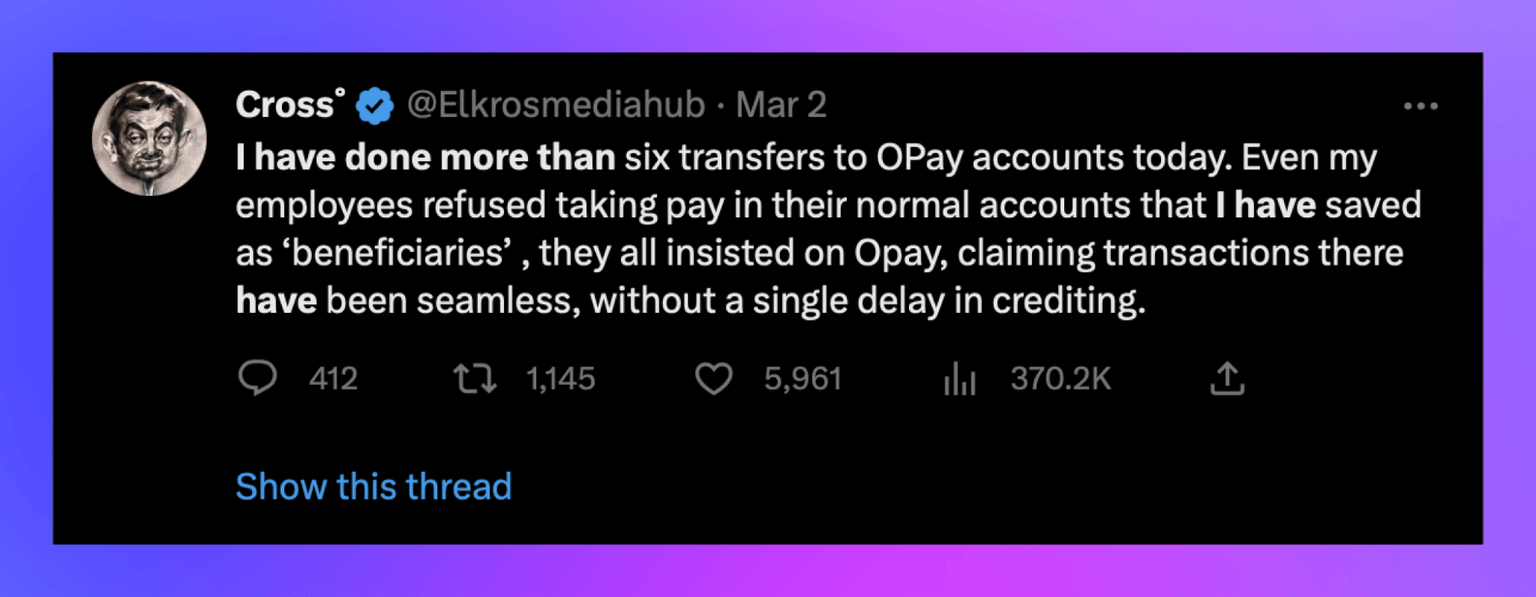

In Nigeria, there are a number of digital banks that can be referred to as Challenger banks. These include Kuda Bank, Opay, MoniePoint, and PalmPay. Kuda Bank has made a name for itself over the past few years as an online bank with no charges. These banks have become popular alternatives for Nigerians due to the inconsistencies experienced with traditional commercial banks.

While they have had fairly good services, it is important to talk more about the one Challenger bank that has distinguished itself. Since this past month (February 2023), people have been very vocal about their banking experiences. It is quite easy to notice how much praise OPay has been receiving.

It is quite impressive to see how Opay has transitioned from a transportation company into a successful Challenger bank. At first, people were sceptical, but with the continued positive feedback, OPay has succeeded in gaining the trust of Nigerians , and has become very popular among individuals and small businesses.

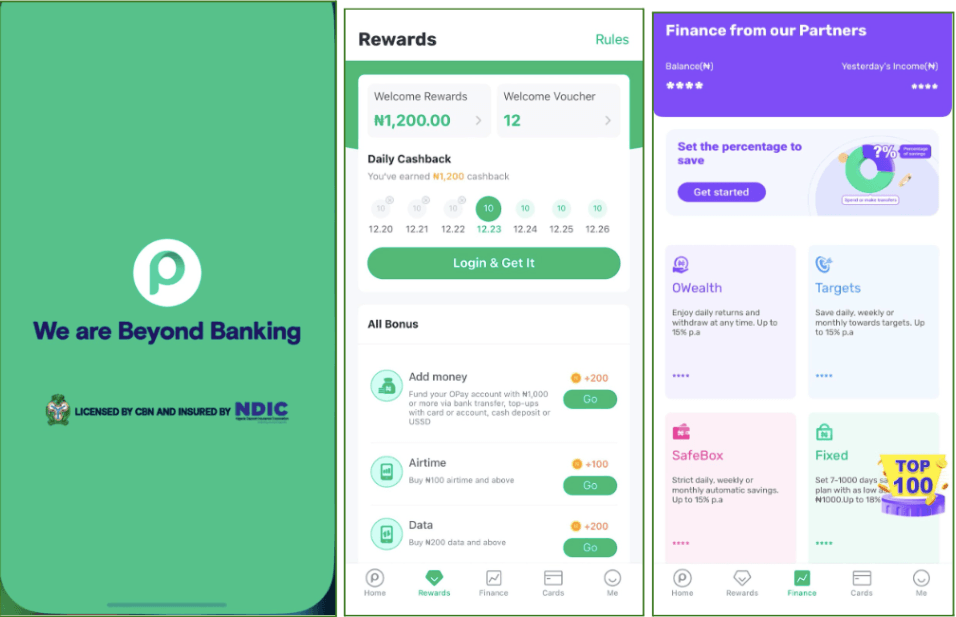

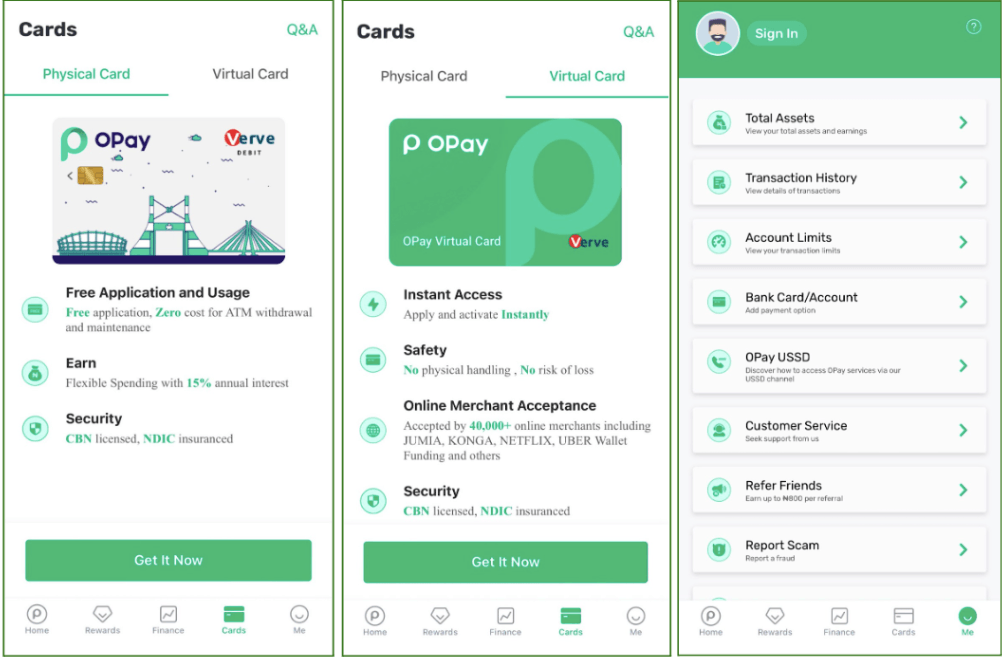

I particularly like how OPay allows the intended customer to see the inside of the app without having to sign up compulsorily. Also, the pop ups explaining the features in the app is a plus making the onboarding process seamless for its customer. Let's have a look at the app’s features, shall we?

Conclusion

Except for a few banks, can we agree that Challenger banks have proven to be more reliable to Nigerians than the standard commercial banks? Also, Titan Trust Bank (a bank that is barely known) came out “top” as the most reliable bank in Nigeria. This comes as a surprise, given that it surpassed well-established banking giants.

Perhaps, the recent ‘Japa’ culture has contributed to this issue. Nigerian banks have experienced a shortage of skilled engineers due to this culture. Many competent engineers have left the banks for international companies and relocation opportunities, primarily because they are not being paid commensurate salaries

Additionally, banks need to improve their mobile application user experience by engaging the services of competent product/ UI,UX designers. This is an area where the Challenger banks have excelled. They provide a shorter and more seamless banking experience for their customers.